Asian markets experienced a downturn on Monday as the Japanese yen strengthened significantly against the U.S. dollar, impacting major exporters. The benchmark Nikkei 225 index fell by 1.9% to close at 52,812.45, driven by declines in shares of companies such as Toyota Motor Corp., which saw a drop of 3.2%. A weaker currency typically benefits Japanese exporters, enhancing the value of their overseas earnings, but recent fluctuations have raised concerns.

The yen’s rise follows a period where it had been weaker against the dollar, which had been trading at around 158 yen last week. Recent comments from officials in both Japan and the United States suggested a willingness to intervene in currency markets to stabilize the yen, causing the dollar to slip to 154.26 yen from 155.01 yen.

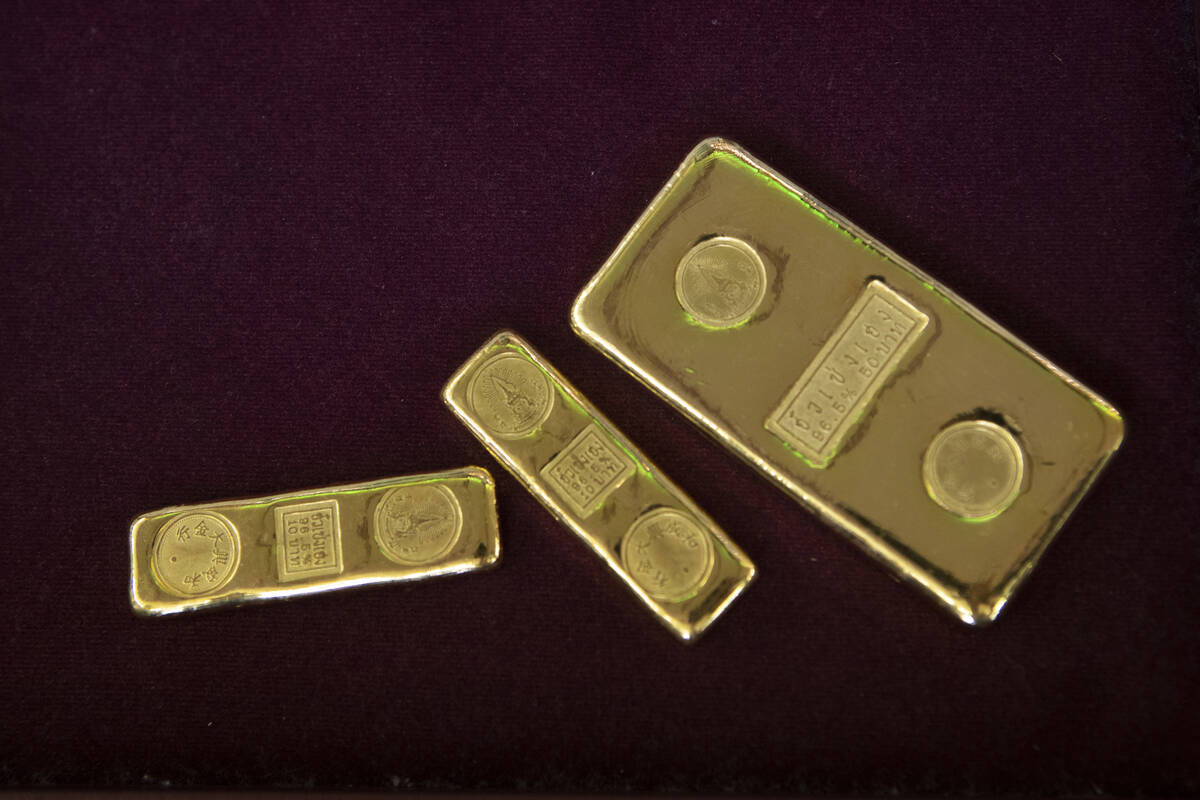

Precious Metals Surge Amid Economic Uncertainty

In the commodities market, gold prices surged 2% to nearly $5,100 per ounce, while silver jumped 6.4% to approximately $108 per ounce. The increasing value of precious metals reflects a growing investor preference for safe-haven assets amid ongoing economic uncertainty.

The euro also experienced a slight increase, rising to $1.1866 from $1.1858. In broader Asian markets, South Korea’s Kospi index fell 0.6% to 4,961.58, while Hong Kong’s Hang Seng index inched down 0.1% to 26,722.89. Conversely, the Shanghai Composite managed a slight gain of 0.1% to close at 4,141.10.

Markets in Australia, New Zealand, India, and Indonesia remained closed for the day. Meanwhile, U.S. futures for the S&P 500 and the Dow Jones Industrial Average dipped 0.3% as uncertainty around U.S. tariff policies lingered.

Trade Tensions and Market Reactions

The backdrop of trade tensions continues to affect market sentiment. Notably, U.S. President Donald Trump threatened to impose a 100% tariff on Canadian goods, a move countered by Canadian Prime Minister Mark Carney, who stated that Canada had no intentions of signing a free trade agreement with China. In 2024, Canada mirrored the U.S. by implementing a 100% tariff on electric vehicles from China and a 25% tariff on steel and aluminum. In retaliation, China imposed 100% import taxes on Canadian canola oil and meal, along with 25% tariffs on pork and seafood.

During a recent visit to China, Prime Minister Carney announced a reduction of Canada’s 100% tariff on Chinese electric cars in exchange for lower tariffs on Canadian exports. On Wall Street, the S&P 500 edged up less than 0.1% to close at 6,915.61, marking a second consecutive week of modest losses. The Dow Jones Industrial Average fell 0.6% to 49,098.71, while the Nasdaq composite rose 0.3% to 23,501.24.

Investors are now looking ahead to the upcoming meeting of the U.S. Federal Reserve on Wednesday, where the central bank is expected to maintain current short-term interest rates. The market remains cautious as it navigates through ongoing trade tensions and economic uncertainties.