Leaders of nonprofits in Grand Forks are expressing deep concern over proposed cuts to the city’s community service grant program, a move they say would significantly hinder their operations. Everett Jones Sr., Director of the Northlands Rescue Mission, stated, “As far as Northlands Rescue Mission is concerned and our operational expenses, that would be a pretty significant blow.” He emphasized that their grant applications are driven by necessity rather than surplus funds.

In the proposed budget for 2026, the city plans to allocate zero funds to programs including the community service grant (CSG) program, the Arts ReGrant, and special event funding sourced from sales tax collections. While the infrastructure for these programs will remain, the lack of funding means no grants can be disbursed. The CSG program, established in 2019, enables nonprofits to apply for operational grants that undergo review by the Community Advisory Committee and the Grand Forks City Council.

The CSG program is usually administered alongside the Community Development Block Grant (CDBG), which provides federal funding for competitive grants aimed at physical projects. Currently, there is $400,000 available for grants, which is $10,000 less than last year.

Heather Novak Fuglem, Executive Director of the United Way of Grand Forks and East Grand Forks, highlighted the potential difficulties her organization could face without this funding. “It’ll affect us mostly for our homeless families who are trying to get into long-term housing,” she noted. The absence of resources through the CSG program could hinder efforts to assist families with essential needs, such as rental arrears and obtaining identification documents.

Jones called for collaboration between the city and local nonprofits to address potential funding gaps. “We have to be mindful that we are not the whole — we are part of it. So I want to make sure that we are garnering goodwill with the city,” he said. He remains hopeful that local philanthropists will step forward to help bridge funding shortfalls that could impact essential programs.

In 2025, Grand Forks recorded a 12-month rolling average of sales tax collections between $33.8 million and $35.5 million. The city currently allocates approximately $2.5 million annually to its Economic Development Fund, which supports programs like the CSG. The proposed budget reflects increased expenses related to public safety and infrastructure, both partially funded by sales taxes.

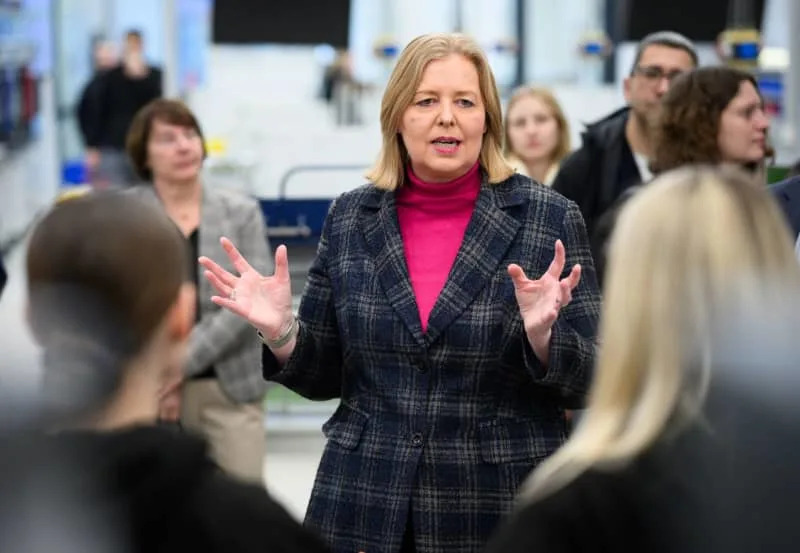

City Director of Finance Maureen Storstad explained the rationale behind the budget adjustments: “That general 1% sales tax that the mayor is recommending shifting a bit on that allocation is because of the need for street capital projects and also the need for a long-term sustainable look with property tax caps and the additional public safety component need in the general fund.”

Grand Forks’ sales tax is divided into three categories: 1% goes into the general fund, infrastructure fund, and economic development fund; 0.5% is directed toward street and water infrastructure; 0.75% supports event center capital improvements; and a 0.25% tax on restaurant and lodging purchases funds the operations of the Alerus Center.

The City Council is set to vote on the preliminary budget on August 4, amid rising concerns from local organizations that rely on these crucial funds to support their communities.