Boeing and Airbus have indicated that the launch of new next-generation aircraft models is not on the immediate horizon. Speaking at an industry conference in Prague, key executives from both companies emphasized the need to focus on existing projects rather than pursuing new aircraft development.

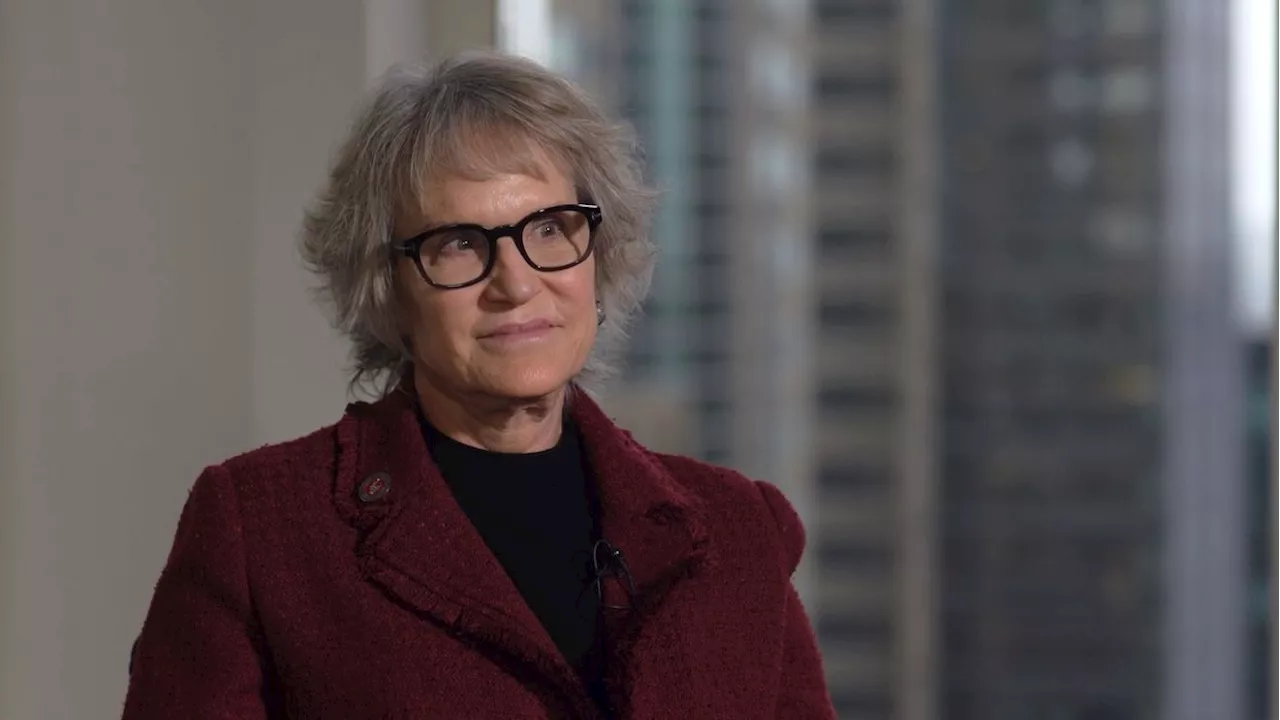

Darren Hulst, Boeing’s head of marketing, stated that a successor to the Boeing 737 is still “some way off.” The company is prioritizing the certification of additional variants of the Boeing 737 MAX, the new Boeing 777X passenger family, and the next-generation freighter, the Boeing 777XF. This strategy is crucial as Boeing navigates approximately $50 billion in debt.

According to analyses by Bloomberg, the certification timeline for the Boeing 777X could extend into 2027, with some experts suggesting that even this date may be optimistic. Recent discussions between Boeing CEO and Rolls-Royce, a prominent engine manufacturer, reflect Boeing’s long-term interest in next-generation technologies, although no specific aircraft announcements are expected soon.

At the same conference, François Collet, Director of Asset Management at Airbus, echoed similar sentiments. He stated that any new aircraft model would need to offer at least a 25% improvement in efficiency to justify development costs. This raises significant questions about the feasibility of such advancements with current technology.

Impact on the Aviation Industry

The decision to delay the introduction of new narrowbody aircraft models has significant implications for the commercial aviation market. Both Boeing and Airbus plan to continue selling their existing models—the Airbus A320neo and Boeing 737 MAX—well into the 2030s. This approach is likely to maintain a backlog of orders and support higher pricing and leasing rates.

Airlines are currently focused on making incremental improvements to efficiency. Instead of introducing entirely new aircraft, they are opting for small derivative models. This cautious strategy may slow down timelines for decarbonization, leaving fuel costs elevated in the overall operational budget.

For aircraft lessors, the current scenario presents a favorable environment. Strong residual values for existing aircraft and manageable placement challenges are expected to continue. Engine manufacturers are prioritizing reliability, which enhances aftermarket revenue opportunities and encourages a focus on established technologies rather than untested innovations.

The Future of Aircraft Development

As the commercial aviation market stands, a shift towards rapid, widespread changes in aircraft technology appears to be years away. The technology necessary for next-generation clean-sheet aircraft models is still a decade off, and manufacturers are not eager to undertake such high-risk projects at this time.

Ultimately, the demand for commercial aircraft will dictate how airlines allocate capital for these development programs. The process of aircraft development is inherently risky, and manufacturers that do not adeptly manage their assets and debts may face challenges in the future.

While both Boeing and Airbus may eventually invest in new aircraft development, the timeline for such decisions remains uncertain. For now, the industry will continue to focus on existing models and incremental upgrades, maintaining a status quo that balances risk with stability.