NEW YORK (AP) — U.S. stocks experienced mixed trading on Tuesday as Wall Street’s recent momentum began to wane following record highs earlier this week. By midday, the S&P 500 had dropped 0.3%, potentially marking its first loss in four days. Meanwhile, the Dow Jones Industrial Average rose by 398 points, or 0.9%, and the Nasdaq composite fell by 1%. The market’s volatility was largely driven by a decline in tech stocks, notably Tesla, which saw its shares fall by 4.9%.

The tension between Tesla’s CEO, Elon Musk, and former President Donald Trump has intensified, impacting the company’s stock performance. Once allies, Musk and Trump have recently clashed, with Trump suggesting potential savings by scrutinizing government spending on Musk’s companies. This feud has contributed to Tesla’s stock dropping more than 21% this year.

Tech Sector Struggles Amid Broader Gains

Several tech stocks, particularly those involved in the artificial intelligence boom, also saw declines. Nvidia, for instance, experienced a 3.3% drop, significantly impacting the S&P 500. Despite these tech sector struggles, the broader market saw gains, with more stocks rising within the index than falling.

Casino companies led the charge, buoyed by a report of better-than-expected growth in gaming revenue in Macao, China’s casino hub. Wynn Resorts and Las Vegas Sands both saw an 8.4% increase. Automakers, excluding Tesla, also performed well; General Motors rose by 5.3%, and Ford Motor increased by 4.3%.

Economic Context and Challenges Ahead

The U.S. stock market has shown remarkable recovery from a springtime sell-off of approximately 20%. However, challenges loom, particularly with the impending threat of Trump’s tariffs. While many proposed tariffs are currently paused, they are scheduled to take effect soon, potentially harming the economy and exacerbating inflation.

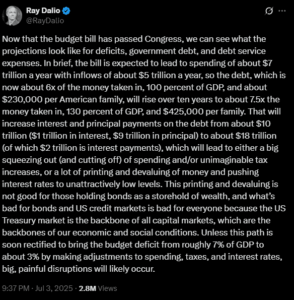

Congress is also debating tax cuts and other measures that could increase the national debt, potentially driving inflation higher. This scenario could lead to higher interest rates, negatively affecting bonds, stocks, and other investments. Despite these challenges, Barclays strategists have noted signs of euphoria among investors, reminiscent of past market bubbles.

“Market bubbles are infamously difficult to predict and can endure far longer than anticipated before correcting,” noted Barclays strategists Stefano Pascale and Anshul Gupta.

Bond Market and Federal Reserve’s Stance

In the bond market, Treasury yields rose following mixed economic reports. One report indicated an increase in job openings, suggesting a potentially strengthening job market. However, manufacturing data was mixed, with the Institute for Supply Management reporting a contraction in U.S. manufacturing activity, albeit less severe than the previous month.

The yield on the 10-year Treasury increased to 4.27% from 4.24%, and the two-year Treasury yield rose to 3.78% from 3.72%. This data could influence the Federal Reserve’s decision on interest rates. Fed Chair Jerome Powell reiterated the need for more evidence on the economic impact of tariffs before making further rate cuts, despite Trump’s calls for quicker action.

Global Market Reactions

Internationally, stock markets showed mixed results. In Asia, Japan’s Nikkei 225 fell by 1.2%, while South Korea’s Kospi rose by 0.6%. European markets also displayed varied performances, reflecting the complex global economic landscape.

As Wall Street navigates these turbulent waters, investors and analysts alike are closely monitoring economic indicators and geopolitical developments that could shape the market’s future trajectory.