WASHINGTON (AP) — Federal Reserve Chair Jerome Powell reiterated his commitment to a cautious monetary policy stance on Tuesday, maintaining that the central bank will keep its key interest rate unchanged while assessing the economic impact of President Donald Trump’s tariffs. This comes amid a barrage of criticism from the White House, which is advocating for lower borrowing costs to spur economic growth.

Speaking at a conference in Sintra, Portugal, hosted by the European Central Bank, Powell acknowledged the potential for U.S. inflation to rise later this summer, although he admitted the timing and scale of any price increases due to tariffs remain uncertain. “As long as the economy is in solid shape, we think the prudent thing to do is to wait and see what those effects might be,” Powell remarked, referencing the extensive tariffs imposed by Trump this year.

Fed’s Independence Under Scrutiny

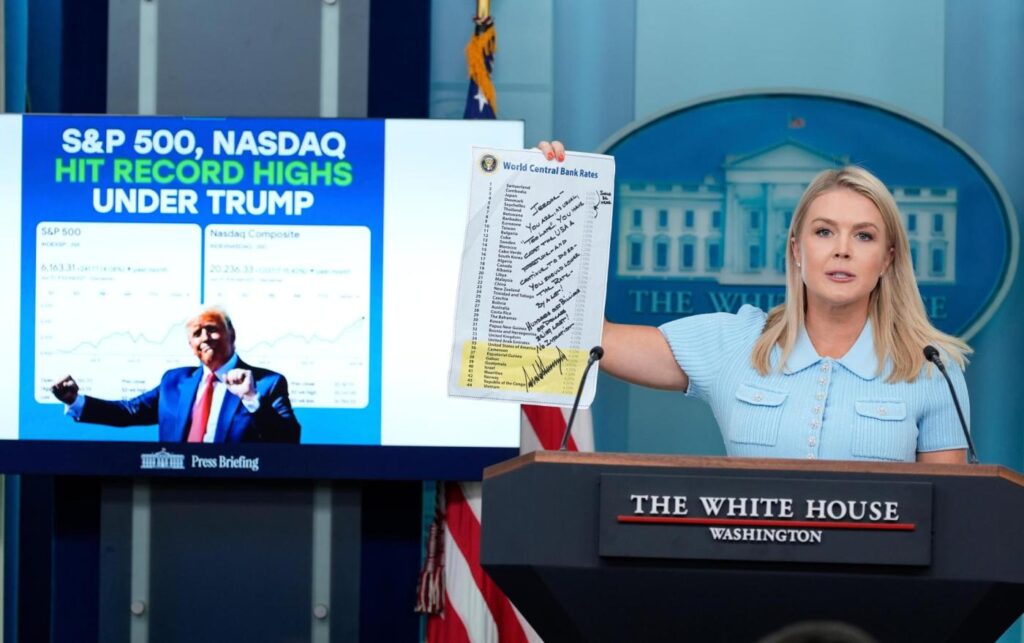

Powell’s comments highlight the growing rift between the Federal Reserve and the Trump administration. President Trump has persistently called for a reduction in the Fed’s key rate, arguing it would lower interest costs on the federal government’s substantial debt and stimulate the economy. This ongoing conflict has raised questions about the Fed’s traditional independence from political influence. However, since the Supreme Court indicated that the president cannot dismiss the Fed chair, financial markets have largely disregarded Trump’s critiques.

The Fed chair also noted that absent the tariffs, the central bank might have already opted to lower its key rate. “The central bank went ‘on hold’ after it saw how large Trump’s proposed tariffs were,” Powell explained, as economists began predicting higher inflation.

Potential Rate Cuts on the Horizon?

Despite maintaining the current rate, Powell did not dismiss the possibility of a rate cut at the Fed’s upcoming policy meeting on July 29-30. “I wouldn’t take any meeting off the table or put it directly on the table,” he stated. Nonetheless, most economists anticipate that the Fed will not reduce rates until at least September.

On Monday, President Trump escalated his attacks, extending his criticisms to the entire Fed governing board, which participates in interest-rate decisions. “The board just sits there and watches, so they are equally to blame,” Trump declared. This broadside increases pressure on individual Fed officials, such as Governor Chris Waller, who have been mentioned as potential successors to Powell, whose term concludes in May 2026.

Historical Context and Future Implications

The Federal Reserve has maintained its key short-term interest rate at approximately 4.3% this year, following three rate cuts in 2024. At a June news conference, Powell suggested that the central bank would “learn a great deal more over the summer” regarding the inflationary effects of Trump’s tariffs, implying that any rate cuts would likely be deferred until the September meeting.

However, shortly thereafter, Fed governors Chris Waller and Michelle Bowman, both Trump appointees, expressed skepticism that the tariffs would lead to sustained inflation. They also indicated a probable inclination to support a rate reduction at the July 29-30 meeting.

As the Federal Reserve navigates these turbulent waters, the implications of its decisions will resonate across the global economy. The central bank’s cautious approach reflects a broader strategy to balance economic growth with inflation control, amid unprecedented political pressure. The outcome of this delicate balancing act will likely influence economic policy and market stability in the months ahead.