UPDATE: Warner Bros. Discovery has officially launched a high-stakes auction for the media giant, sparking a competitive bidding atmosphere just confirmed by multiple sources. The company, which oversees renowned brands like HBO, CNN, and the Warner Bros. studio, is reportedly evaluating offers through financial advisers at JPMorgan and Allen & Co. as of July 6, 2023.

Prospective bidders, including a notable interest from Paramount Skydance, have received non-disclosure agreements to examine WBD’s financials. This auction comes on the heels of a board meeting where executives discussed the bidding process amid increasing pressures from potential suitors.

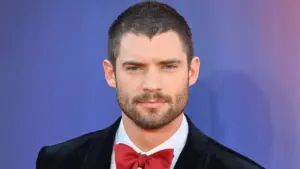

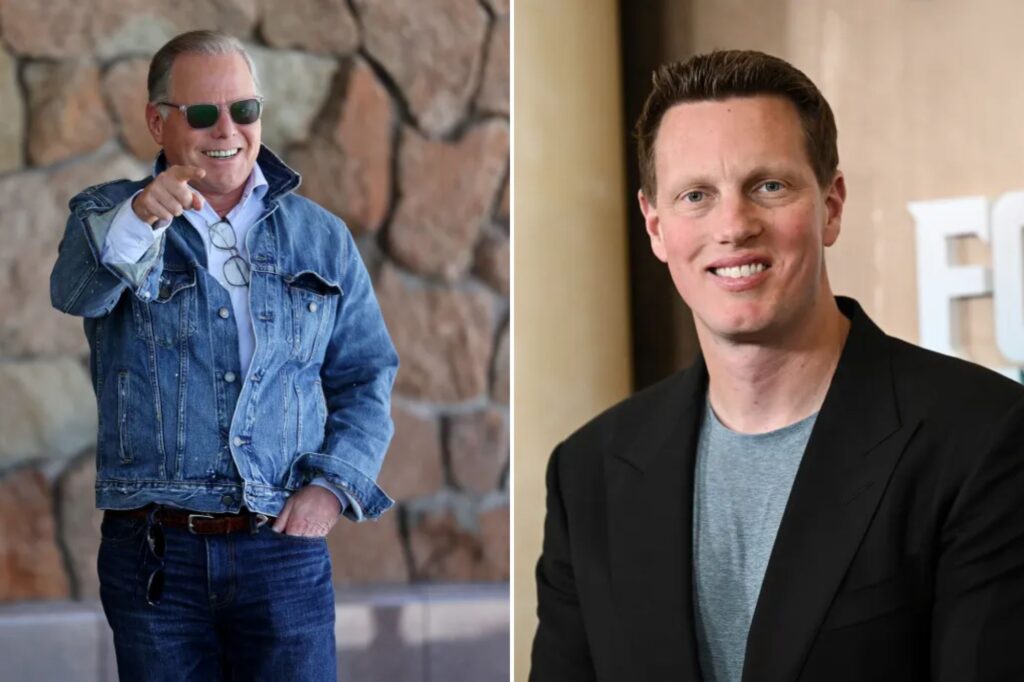

The most aggressive bidder, David Ellison, CEO of Paramount Skydance, has made headlines with three bids for WBD, the latest being a staggering $23.50 per share, valuing the company at $56 billion. Despite these attempts, WBD’s CEO David Zaslav has rejected each offer, anticipating an even larger bidding war to push the sale price above $25 per share.

According to insiders, Zaslav is bracing for another move from Ellison, possibly a public or hostile bid, in the coming days. However, Ellison’s strategy reportedly hinges on the belief that he has the backing of former President Donald Trump, which could complicate matters for rival bidders such as Netflix, Amazon, and Comcast.

Ellison’s advisers suggest that Trump may not approve Comcast’s ownership due to its connections with politically charged programming, creating potential hurdles for a bidding process that is already fraught with regulatory challenges. A Comcast spokesperson declined to comment on this intricate web of negotiations.

Zaslav’s leadership at WBD has already shown significant improvements, with the company recently surpassing $4 billion in box office revenues and achieving 73 million global subscribers on HBO Max. Despite the current uncertainties, Zaslav is reportedly committed to restructuring WBD into two distinct units, one focusing on its studio and streaming assets, and the other on cable properties.

As this auction unfolds, analysts speculate that WBD’s studio and streaming divisions could be valued as high as $30 per share, providing a strong incentive for bidders to escalate their offers. A source familiar with Zaslav’s perspective stated, “He feels like ‘we did what he was supposed to do: Fix the company and then if he has to sell at a premium.’”

With multiple parties vying for control, the outcome of this auction could reshape the media landscape dramatically. Stakeholders are watching closely as the bidding war intensifies, signaling a pivotal moment for Warner Bros. Discovery and the future of its iconic brands.

Stay tuned for more updates as this developing story continues to unfold.