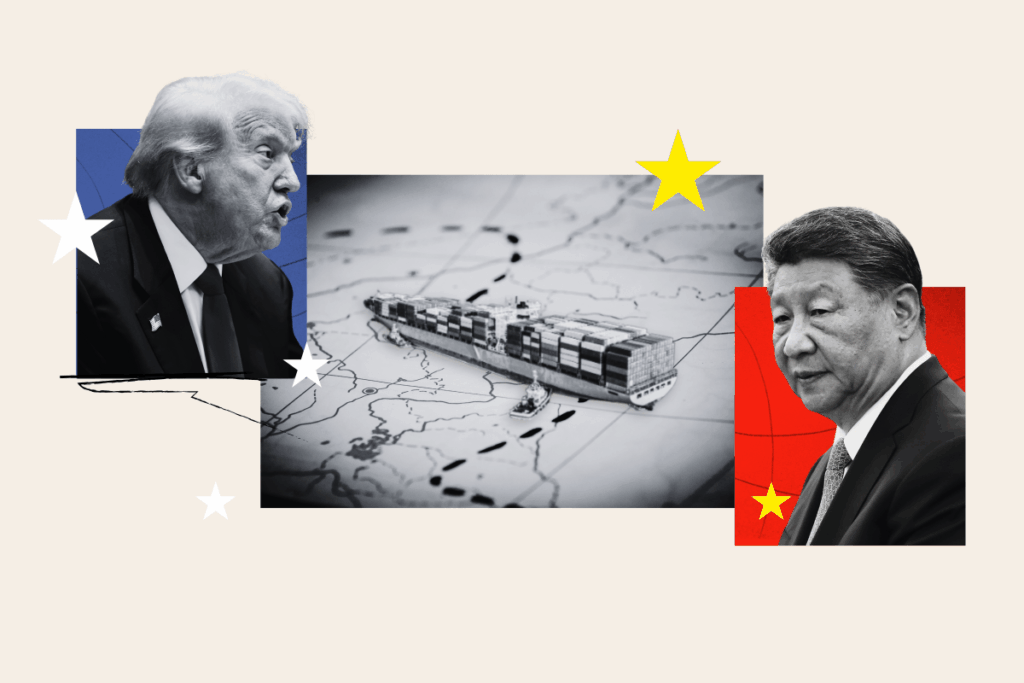

URGENT UPDATE: New reports confirm that the United States has received more loans from China than any other nation, totaling a staggering $202 billion over the past 24 years. This groundbreaking revelation, released by the AidData research lab at the College of William & Mary, challenges long-held beliefs about China’s lending practices and their focus on developing nations.

According to the comprehensive study, which tracked over 30,000 projects across 217 countries from 2000 to 2023, China’s total overseas lending amounts to a jaw-dropping $2.2 trillion. The report indicates that more than 75% of these loans are directed towards wealthy countries, aiming to enhance China’s geopolitical influence through strategic investments in critical infrastructure, minerals, and high-tech assets.

Brad Parks, executive director of AidData and lead author of the report titled Chasing China: Learning to Play by Beijing’s Global Lending Rules, stated, “The overall size of China’s portfolio is two-to-four times larger than previously published estimates suggest.” This highlights a significant shift in China’s lending strategy, which is now closely aligned with its ambitions to assert dominance in global technology and industry.

Following the U.S., the countries receiving the highest amounts of Chinese loans include Russia with $172 billion, Australia at $130 billion, and Venezuela at $106 billion. The implications of these loans extend beyond mere financial transactions; they represent a calculated move by China to strengthen its economic statecraft and align its investments with national objectives.

The report also draws attention to the U.S. response, indicating that the recent $20 billion bailout to Argentina mirrors China’s targeted lending approach. Both the Biden and Trump administrations have shifted their strategies to secure stakes in critical infrastructure and mineral assets in high-income countries, including strategic sites like Greece’s Piraeus Port and Australia’s Darwin Port.

Furthermore, discussions in Congress have emerged about increasing the lending cap of the U.S. International Development Finance Corporation from $60 billion to $250 billion. This would allow the agency to operate with greater flexibility on projects deemed significant for national security, further reflecting the urgency of addressing China’s strategic advantages.

As the global landscape shifts, policymakers in Western nations are being compelled to rethink their approaches to aid and credit. Unlike China’s centralized system, which aligns corporate actions with national policy, democratic countries are struggling to coordinate effectively, potentially hindering their competitive edge.

This report serves as a wake-up call, emphasizing the pressing need for the U.S. and its allies to adapt their strategies in light of China’s growing influence and the changing dynamics of global lending. As these developments unfold, the implications for international relations and economic policies will be profound, demanding immediate attention from leaders worldwide.

Stay tuned for more updates as this story continues to evolve.