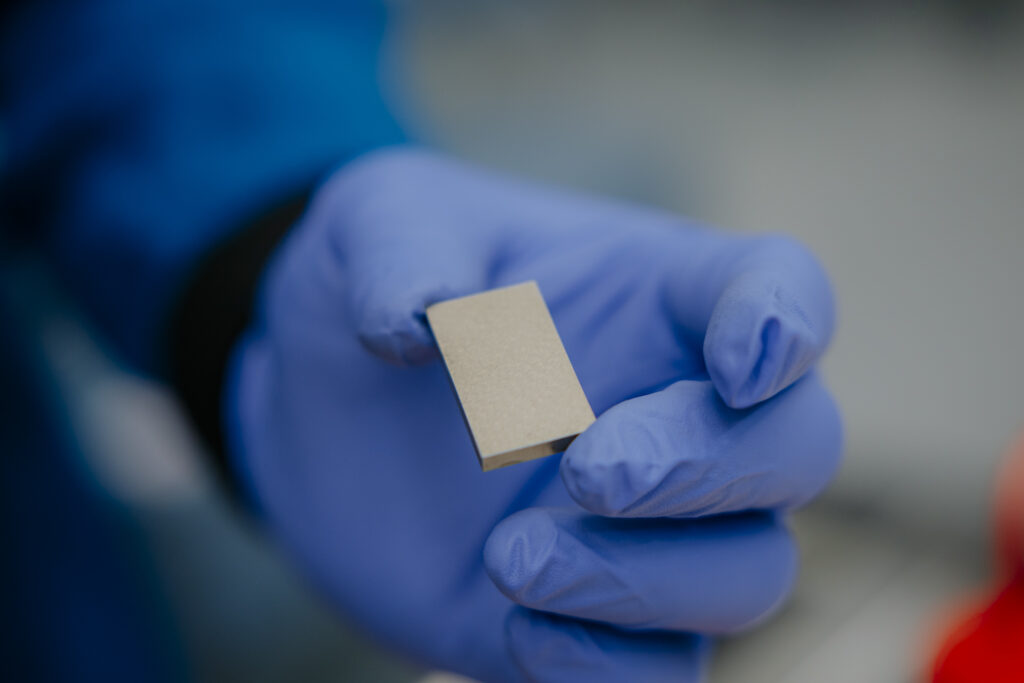

A major shift in the U.S. approach to rare earth minerals has occurred with the announcement of a new partnership between MP Materials and the United States Department of Defense. The deal, valued at $400 million, aims to enhance domestic production of rare earth elements, which are essential for both civilian and military technologies. This initiative is seen as a strategic move to reduce the United States’ dependence on China, which currently dominates the global rare earth market.

MP Materials revealed that it has entered into a public-private partnership with the Pentagon to accelerate the development of an end-to-end supply chain for rare earth magnets in the U.S. This partnership will provide the Defense Department with a 15 percent ownership stake in the company, which operates the Mountain Pass Mine in California—the only facility of its kind in the country. While MP Materials processes rare earth concentrate, the bulk of final refining and magnet production still occurs in China, highlighting the need for enhanced domestic capabilities.

China’s Dominance and U.S. Vulnerability

Currently, China supplies approximately 70 percent of the rare earths imported by the United States and controls about 85 percent of the world’s refining capacity. This reliance has raised concerns among U.S. officials, who view it as a significant vulnerability. The Trump administration has been actively pursuing new agreements to bolster domestic production, including a deal with Ukraine in May 2023.

According to James Litinsky, Founder, Chairman, and CEO of MP Materials, the partnership marks a decisive step toward achieving supply chain independence in the U.S. He stated, “This initiative will dramatically accelerate the build-out of a U.S. rare earth magnet supply chain and reduce foreign dependency.” Following the announcement, shares of MP Materials surged by over 50 percent during early trading.

In April 2023, China demonstrated its ability to influence global supply by imposing restrictions on certain rare earth exports in response to U.S. tariffs. Although Beijing eased these restrictions last month following a trade truce, U.S. officials noted that shipments had not yet returned to pre-restriction levels. In March 2023, President Trump invoked emergency powers under the Defense Production Act to support the expansion of domestic production of critical minerals.

Future Developments and Industry Reactions

The United States is set to increase its capacity in the rare earth sector significantly. In addition to enhancements at Mountain Pass, MP Materials is planning to construct a second domestic magnet manufacturing facility, dubbed the “10X Facility.” This project will receive partial funding from a commitment of $1 billion from JPMorgan Chase and Goldman Sachs Bank USA.

Industry experts have expressed mixed opinions on the implications of this partnership. Arnab Datta, Managing Director of Policy Implementation at Employ America, highlighted the complexity of the deal on social media, noting the significant financial risks associated with tying so much investment to a single project. Conversely, Michael McNair, a fund manager at a large U.S.-based asset manager, emphasized the importance of such initiatives in securing domestic supply chains, predicting more similar agreements in the future.

As the U.S. continues to navigate its rare earth supply challenges, the recent partnership with MP Materials represents a critical step toward enhancing national security and economic stability in the face of global competition. The ongoing developments in this sector will likely have lasting implications for technology, defense, and international trade.