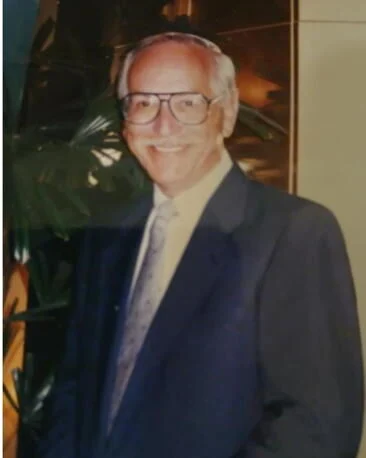

URGENT UPDATE: Two retail traders have transformed their Discord chat into a thriving investment fund, Enders Capital, now boasting $5 million in assets under management. Co-founders Moody Nashawaty and Risley Mabile launched the fund after meeting on the platform in 2022, marking a significant shift in the retail trading landscape.

This latest development highlights a trend where retail traders are moving beyond mere memes and online banter to establish professional investment strategies. With the pandemic-era retail trading boom evolving, Nashawaty and Mabile aim to bring institutional-level professionalism to their investors.

The duo’s journey began in a chaotic Discord server dedicated to retail traders. They spent months exchanging ideas and insights before deciding to launch their fund, named after Orson Scott Card’s sci-fi classic, “Ender’s Game,” in 2025. Mabile recalls, “I remember him floating the idea to me just in passing, and then followed up two weeks later. I had thought about it, and I was like, you know, I really think maybe this could work.”

Enders Capital is registered under the Securities and Exchange Commission’s Rule 506(c) as an alternative investment fund. The fund’s strategy is rooted in quantitative analysis, utilizing data and automation to minimize volatility and enhance stability. Their automated trading is powered by Composer, a platform that enables retail traders to build sophisticated strategies akin to those used by hedge funds.

Recent gains have been driven by sectors like technology, gold, and emerging markets. Nashawaty emphasizes the importance of community, stating that while some retail investing forums may have a poor reputation, they are often frequented by highly qualified individuals who deeply understand market dynamics. “The next generation of hedge funds won’t be from Wall Street, and I think that’s a good thing,” he added.

Both founders have extensive trading experience; Nashawaty transitioned from a long career in digital marketing, while Mabile balanced his medical residency with his passion for trading. Their unique backgrounds have allowed them to blend expertise from different fields, creating a diverse approach to investment management.

As the investment landscape continues to evolve, Composer CEO Benjamin Rollert predicts that Enders Capital’s model will inspire other new funds. “Much of the fixed overhead required to operate a huge fund will be delegated to AI as models advance,” he stated, suggesting a forthcoming shift towards meritocratic evaluation in the investing world.

This compelling shift in the retail trading arena signifies that the future of investment management may increasingly come from community-driven initiatives on platforms like Discord. With their unique blend of technology and trading expertise, Nashawaty and Mabile are proving that the next wave of financial innovation may very well arise outside traditional Wall Street confines.

Stay tuned for more updates as this story develops.