UPDATE: Gold spot prices remain steady at $3,392 even as COMEX futures surge, following the announcement of surprise tariffs that are reshaping the gold market landscape. This unexpected move has left traders and investors in a state of uncertainty, raising questions about future price trajectories.

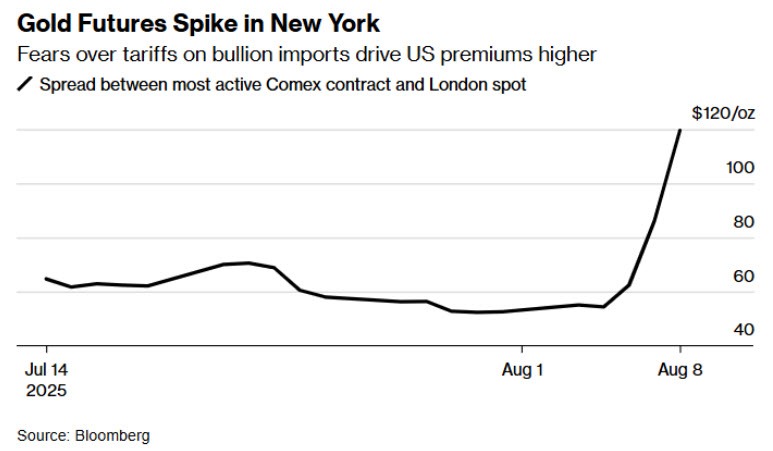

The recent tariffs mean that gold will now be significantly more expensive in the U.S. compared to international markets. This has led to an unusual price discrepancy between COMEX and the London Metal Exchange (LME). Typically, price differences arise due to contract specifications tied to physical deliveries, but the current situation points to deeper market implications.

Gold must be refined in Switzerland before being transported to the U.S. for delivery, as COMEX mandates specific bar sizes. This refining process, which affects around 90% of gold sourced from industrial mines, has now become costlier due to the tariffs, complicating the supply chain.

As markets grapple with these changes, UBS has warned of potential funding stresses. The effects of the tariffs were not anticipated, leaving traders caught off guard. The gold rush witnessed in January and February has not continued, leading to a cautious atmosphere in trading rooms worldwide.

Despite the turmoil, gold lease rates have remained relatively stable, currently hovering at -0.18%, a stark contrast to the spike of 5% earlier this year. This stability suggests a sufficient supply of gold in London for the time being, and traders appear to be taking a wait-and-see approach.

With the Trump administration’s tariff announcement, the market is on high alert. Traders are questioning whether this is a mere technicality or a deliberate strategy to increase U.S. Treasury reserves by revaluing gold held by the Treasury. If this interpretation holds, we could see prices surge further as demand increases and the supply chain tightens.

The implications of this situation are profound. If the tariffs are indeed aimed at boosting U.S. gold reserves, the market could face a revaluation, leading to significant price hikes. The potential for paper shorts to be “burned” as demand outstrips supply adds another layer of complexity to the unfolding scenario.

As the U.S. moves forward, all eyes are on the Trump administration for clarification. Official statements will be crucial in determining the market’s next steps. For now, the gold market remains in a delicate balance, with traders closely monitoring developments.

Stay tuned for more updates as this story evolves. The impact of these tariffs could redefine the gold market landscape, making it a critical moment for traders and investors alike.