BREAKING: A remarkable story of homeownership unfolds as Jasmine Austin, a 27-year-old kindergarten teacher from Richmond, Virginia, successfully transitions from renting to owning her first home with the help of a $20,000 down payment grant. This development comes as many millennials grapple with escalating rental costs and housing availability.

Jasmine’s journey began in 2020 when she faced rising rent prices while living with her parents. With a lease for a two-bedroom apartment at $1,700 per month and fears of increasing costs, she explored alternatives to secure her own living space. Concerned about the uncertainty of renting and inspired by her sister, who worked in a mortgage company, Jasmine delved into the homebuying process.

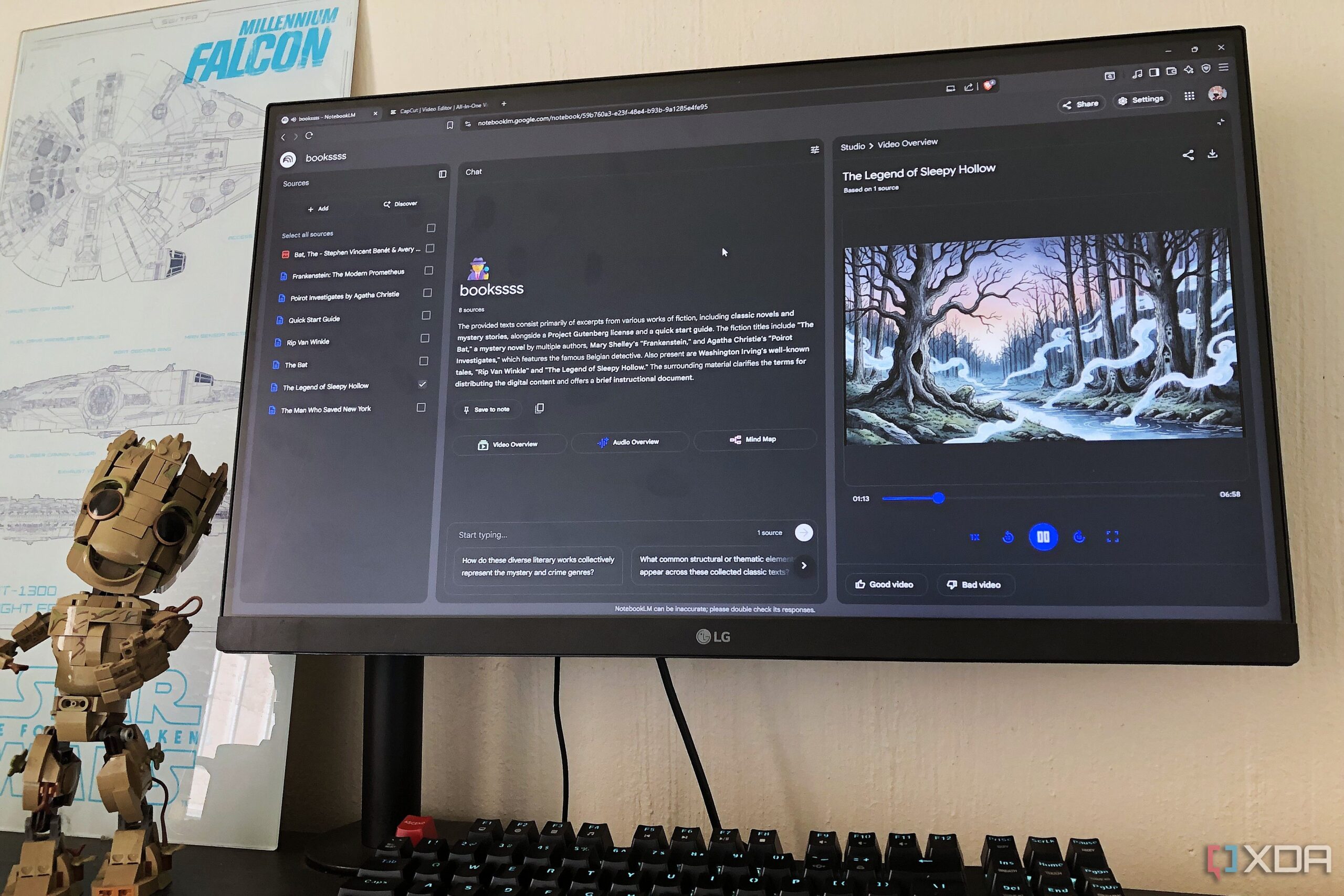

She discovered the Local Initiatives Support Corporation (LISC), a nonprofit dedicated to affordable housing solutions. After researching LISC Virginia’s programs, Jasmine enrolled in classes that educated her on the homebuying process, budgeting techniques, and financial management.

During this transformative period, Jasmine learned to prioritize her wants and needs, which empowered her to secure the down payment assistance she needed. “Living as if I were already paying a mortgage made the transition easier,” she noted, reflecting on her budget adjustments.

In April 2023, Jasmine signed for her new home, and by October, she closed the deal, only needing to write a check for less than a dollar at closing. Her monthly mortgage payment stabilized at $1,900, significantly lower than the initial rental estimate of $2,200.

This urgent story highlights the importance of utilizing available resources. Jasmine’s experience serves as a beacon of hope for other first-time homebuyers, particularly millennials who may feel that homeownership is out of reach. She encourages others to seek assistance, stating, “Ask for help when you need it. Pride can hold you back if you think you have to figure it all out alone.”

As the housing market continues to evolve, Jasmine’s success illustrates a critical pathway for aspiring homeowners in today’s challenging economic landscape. With her new home providing stability and an opportunity to build equity, she plans to explore upgrading to a different style home in the coming years.

This developing story underscores the pressing need for accessible housing solutions and financial literacy programs that can empower individuals like Jasmine to achieve their homeownership dreams.

Stay tuned for more updates on housing trends and assistance programs that may change the lives of potential homeowners.