URGENT UPDATE: The federal government is set to intervene in the housing market, with bailouts on the horizon aimed at preventing a crash. As affordability plummets for homebuyers, new measures are emerging that could significantly reshape the market landscape in the coming months.

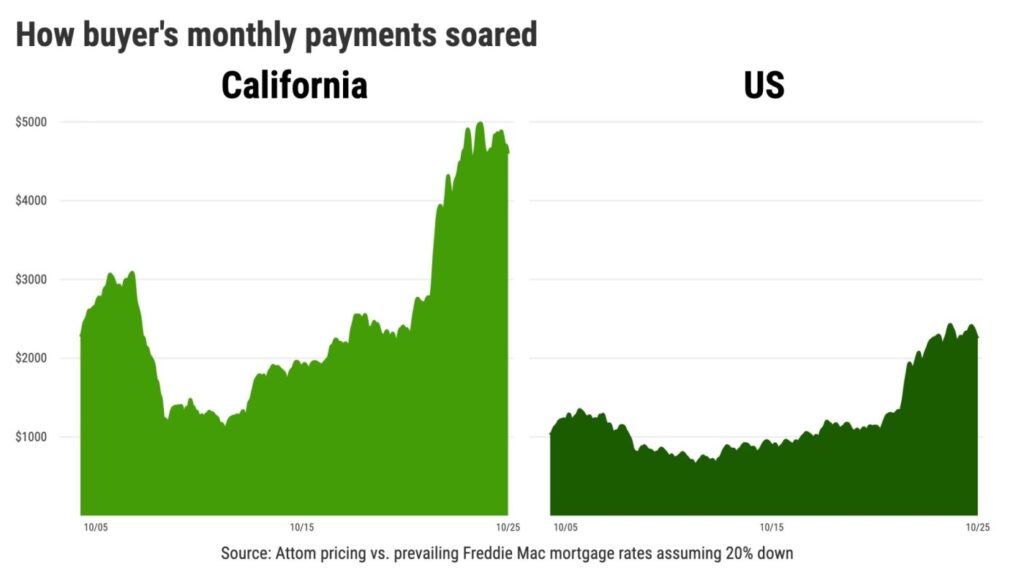

Home prices are teetering on the brink, with many experts predicting a potential crisis. Current data reveals that the national monthly payment for a median-priced home reached $2,251 in October 2023, a mere 2% increase over the past year but a staggering 99% rise over the last five years. In California, the situation is even more dire, where the median-priced home costs $735,000, leading to a monthly payment of $4,597, remaining flat year-over-year but showing a 94% increase over five years and an astounding 267% rise since 2010.

To counteract this affordability crisis, the government is introducing various measures designed to stabilize the market. Among these is the controversial proposal for a 50-year mortgage, aimed at making homeownership more accessible. Additionally, federal mortgage-buying agencies are adjusting their strategies to hold certain loans, thereby reducing mortgage rates and alleviating the financial burdens on borrowers.

Financial incentives are also on the table, particularly for first-time homebuyers. These incentives may include cash grants and tax breaks, which could ease the financial strain but may inadvertently create competition among potential buyers. Current homeowners who have seen significant profits may benefit from tax exemptions, further skewing the market.

However, experts warn that while these interventions may temporarily boost sales, they could lead to long-term market distortions. The last round of government assistance, characterized by the Federal Reserve’s low-interest policies, resulted in a sales collapse once the aid ended. Nationally, home sales have plummeted by 26% compared to the previous three years, with California seeing a 31% drop.

The implications of these bailouts are profound, raising questions about the sustainability of the housing market. As prices remain artificially inflated, the balance between supply and demand is increasingly skewed. While authorities push for immediate solutions, the long-term effects of such manipulation remain uncertain.

WHAT’S NEXT: Homebuyers and investors alike should closely monitor these developments as new policies are rolled out. The housing market’s response to these bailouts could shape the broader economic landscape in 2024 and beyond. Will the government’s intervention stabilize the market, or will it lead to more upheaval?

Stay tuned for further updates as this situation unfolds. The future of homeownership hangs in the balance, and the stakes have never been higher.