URGENT UPDATE: The U.S. Coast Guard is taking immediate action to support families navigating the complex process of final affairs following the death of a loved one. A new handbook aims to ease the burden on survivors, addressing the emotional and logistical challenges they face during this critical time.

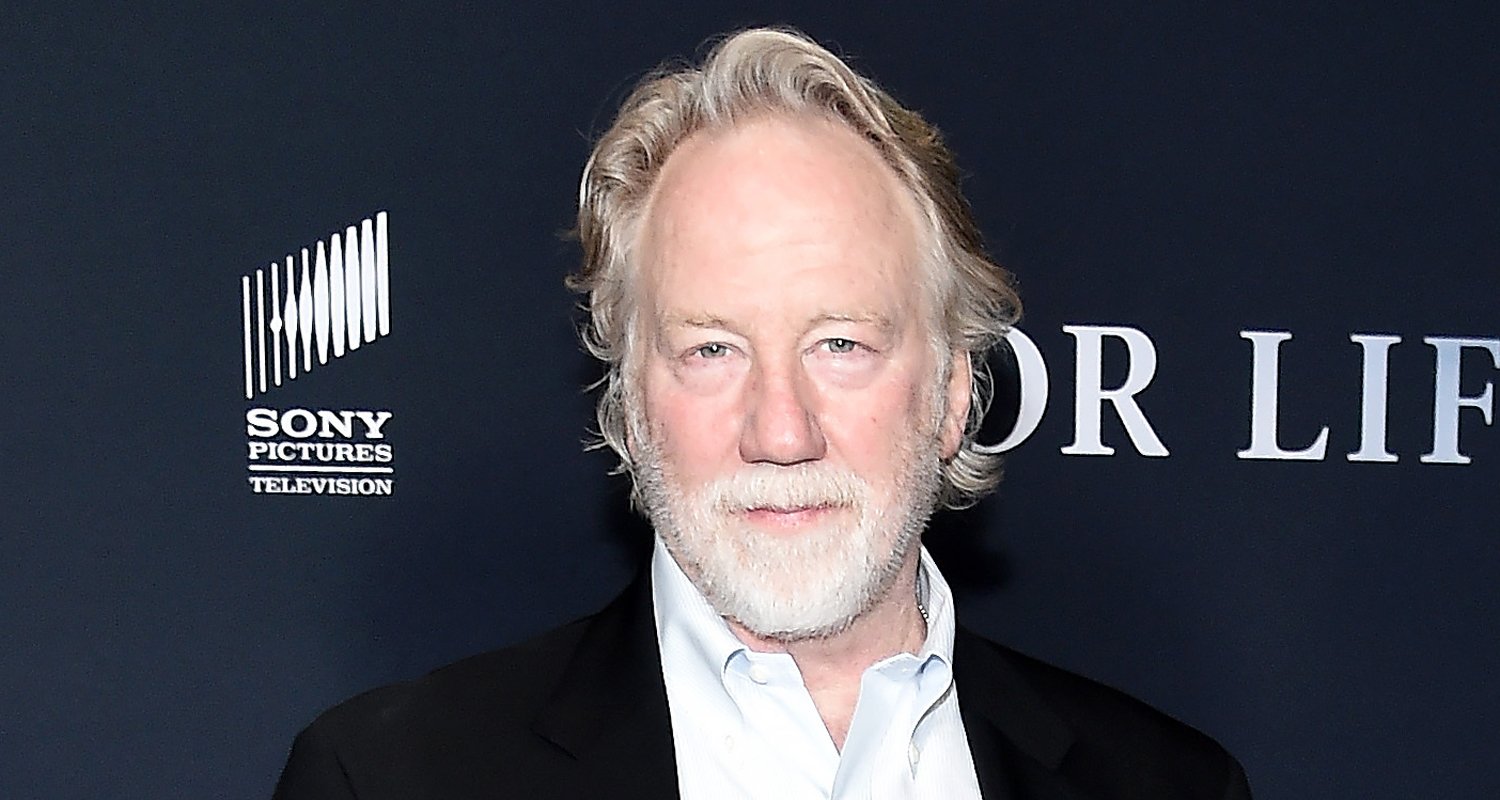

In a recent Broadcast Retirement Network segment, Jeffrey H. Snyder discussed the initiative with Robert C. Hinds, U.S. Coast Guard Retiree Services Program Manager. Hinds emphasized the urgency of financial readiness for military personnel, linking it directly to mission performance and overall well-being.

The handbook is a direct response to the pressing needs of approximately 65,000 retirees and their families who often feel overwhelmed when dealing with final affairs. Many survivors report feeling “paralyzed” and unprepared, prompting the Coast Guard to prioritize this resource.

“We want to foster a culture where our personnel understand the importance of estate planning from the start of their careers,” Hinds stated. “This is vital for mission readiness and emotional stability.”

The Coast Guard’s initiative began over a decade ago, focusing on educating young service members about estate planning as part of their onboarding process. Hinds shared that the handbook is not an official guide but serves to connect families with vital resources and experts in estate planning. “We care about our community and want to support them in every way we can,” he added.

As many families face the intricacies of pensions, retirement accounts, and property divisions, Hinds noted that Coast Guard legal officers are available to assist with creating wills and advanced medical directives. The move aims to ensure that all service members, regardless of their stage in life, are equipped to handle these critical decisions.

“We are starting at the accession points,” Hinds explained. “As new members join, we stress the importance of planning for their future, especially as they progress through their careers.” By instilling these values early, the Coast Guard hopes to create a culture of awareness and preparedness.

In light of recent discussions about financial readiness across military branches, Hinds confirmed that the Coast Guard is redoubling efforts to ensure that all members have their financial houses in order. The creation of a dedicated financial readiness office five years ago is part of this strategy, aiming to enhance support for service members and their families.

As families across the nation look for guidance during times of loss, this initiative by the U.S. Coast Guard represents a crucial step in providing the necessary support and resources. The emotional impact of losing a loved one is profound, and having clear guidance can significantly alleviate stress for survivors.

For those interested in more information on the estate planning handbook or support resources, the Coast Guard encourages reaching out to local legal offices or visiting their official website. Families are urged to take action now to ensure they are prepared for any eventualities.

Stay tuned for more updates on this developing story and how the Coast Guard continues to support its members and their families during challenging times.