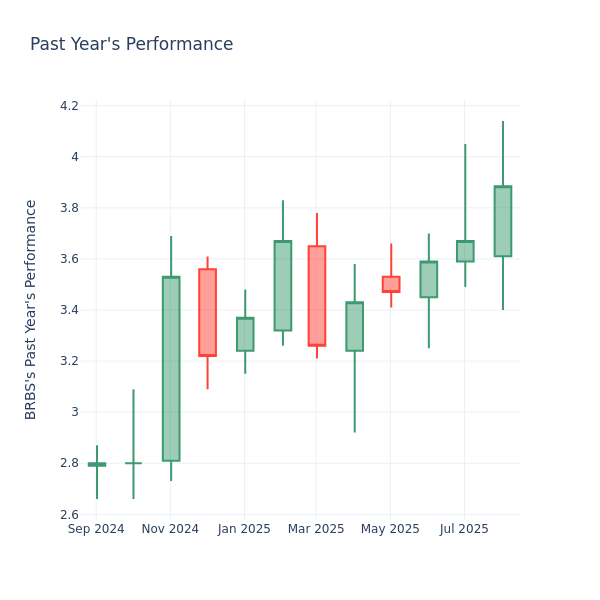

UPDATE: Blue Ridge Bankshares Inc. (BRBS) is experiencing a significant downturn, with its stock price plummeting by 3.60% to $3.88 in the latest market session. This sudden drop raises pressing questions for investors about the company’s valuation and future performance.

Despite the recent decline, the company has seen a 6.15% increase over the past month and an impressive 38.75% rise in the last year. However, today’s downturn has sparked concerns among shareholders regarding whether the stock is overvalued or poised for further struggles.

The P/E ratio, a critical metric for assessing market performance, shows that Blue Ridge Bankshares has a ratio of 11.29, notably lower than the 15.12 average for the broader Banks industry. This disparity may signal to investors that the market does not expect the company to outperform its peers, suggesting potential undervaluation or future growth challenges.

Investors are urged to consider that while a lower P/E can indicate undervaluation, it may also reflect a lack of confidence in the company’s growth trajectory. Experts emphasize that the P/E ratio should not be viewed in isolation; integrating it with other financial metrics and qualitative assessments is crucial for making informed investment decisions.

As the market reacts, shareholders and potential investors are encouraged to stay vigilant. The stock’s performance amidst fluctuating market conditions could influence broader trends within the banking sector.

For those closely monitoring Blue Ridge Bankshares, today’s developments underscore the importance of comprehensive analysis in navigating potential risks and opportunities. Investors should remain alert to further announcements and market shifts that could affect stock valuations.

Stay tuned for more updates as this situation develops. Shareholders are reminded to review their investment strategies in light of the current market dynamics. This news could have far-reaching implications for your investment portfolio.