MoneyGram Reinvents Cross-Border Finance with Next-Generation App

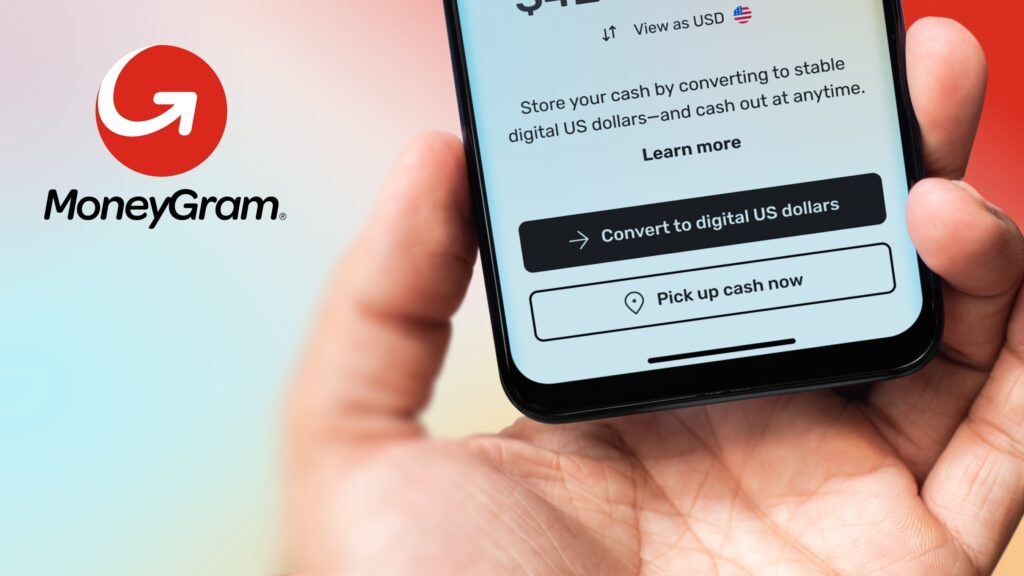

MoneyGram has unveiled its next-generation mobile app, designed to revolutionize cross-border finance. The app, which will launch first in Colombia, utilizes USD-pegged stablecoins to enable users to move and hold money across borders quickly and efficiently. This innovation aims to provide a modern solution to the challenges faced by consumers in sending and receiving money internationally.

The newly introduced digital account allows customers to receive funds instantly in a secure USD balance. It offers the flexibility to store funds in a stable currency and the freedom to cash out or spend as desired. The app promises to enhance the user experience by simplifying the process of managing money, breaking away from outdated, fragmented systems.

For millions who rely on remittances, this launch addresses significant challenges. In regions where families depend on international money transfers, the ability to access funds quickly and securely can be life-changing. MoneyGram’s app is particularly relevant in Colombia, where families receive over 22 times the amount they send abroad. Furthermore, the local currency has depreciated against the U.S. dollar over the past decade, making this service even more essential.

Anthony Soohoo, CEO of MoneyGram, emphasized the company’s commitment to providing universal financial access. “This is where MoneyGram – and money itself – is headed,” he stated. “We believe in a future where financial access is universal, and no one gets left behind.” The app represents a pivotal step towards a unified MoneyGram experience for both senders and recipients globally.

Key Features of the MoneyGram App

The app is designed with several key features to enhance user control and transparency. Funds held in the app will be protected from local currency devaluation, giving recipients greater financial security. Users can manage their funds conveniently, with the option to cash out at MoneyGram locations. Transactions will be secure and trackable, with real-time notifications keeping users informed.

The app also includes personalized communication features, allowing users to send messages alongside their money transfers via platforms like WhatsApp and SMS. Importantly, this service is available to anyone with a smartphone, eliminating the need for a bank account.

Technologically, the app is backed by the Stellar blockchain, which facilitates fast, low-cost payments, and Circle’s USDC, a regulated stablecoin that underscores the app’s secure financial framework. Luke Tuttle, Chief Product and Technology Officer at MoneyGram, noted, “We’ve always believed in doing the hard work to make things simple for the customer.” This approach is evident in the app’s design, which aims to deliver stablecoin utility in a trustworthy manner.

Future Expansion and Accessibility

The MoneyGram app is set to be available for download in Colombia on the Apple App Store and Google Play Store. Early adopters can join a waitlist as the company prepares for a broader rollout. Future features will further integrate physical and digital channels, including the ability to add cash directly into the USD balance via MoneyGram’s retail network.

Users will also have access to linked debit cards for spending in USD globally, helping them avoid unfavorable exchange rates. Additionally, savings options may allow customers to earn incentives on their deposits, enhancing the app’s appeal.

With nearly 500,000 retail locations and over five billion digital endpoints, MoneyGram is positioned as a leader in the cross-border payments sector. The company has been at the forefront of stablecoin integration since 2021, partnering with the Stellar Development Foundation and Circle to build the world’s largest cash on/off-ramp for digital currencies.

MoneyGram’s efforts to innovate responsibly are underscored by its commitment to compliance and regulatory leadership. As stablecoins gain traction in the mainstream market, MoneyGram is poised to provide a seamless, affordable, and secure solution for cross-border money transfers.

With its next-generation app, MoneyGram is not just enhancing accessibility to financial services; it is redefining the future of money, ensuring that users can manage their finances on their own terms.