The Global X Cybersecurity ETF (NASDAQ:BUG) is positioning itself as a potential top investment for 2026, despite facing challenges in the current market. As cybercrime continues to escalate, the ETF’s concentrated holdings in leading cybersecurity companies may provide a strategic advantage over the coming year.

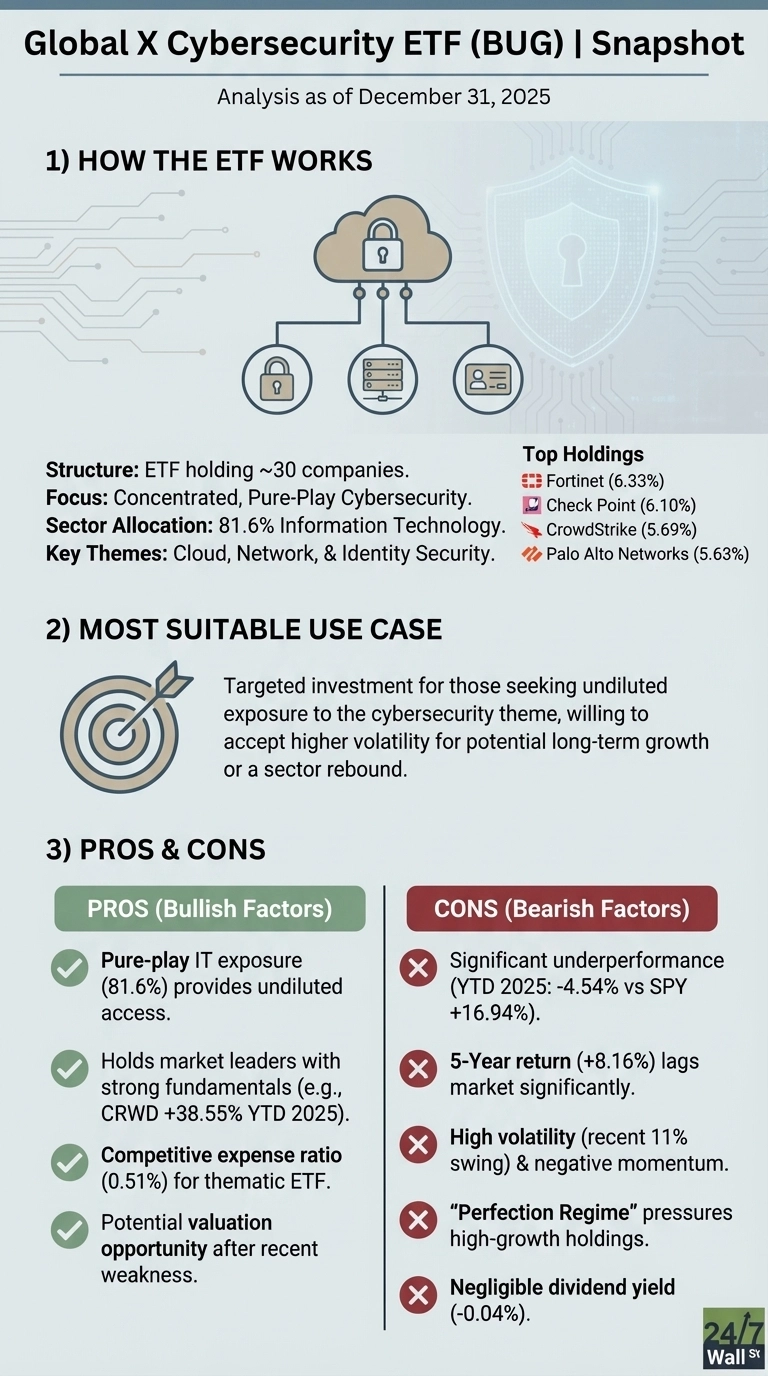

Investors are currently navigating a “Perfection Regime,” where high-growth software firms are expected to deliver flawless performance. This shift in investor sentiment is impacting stocks within the cybersecurity sector, including those held by BUG. Notably, companies such as CrowdStrike, Palo Alto Networks, Fortinet, and Check Point Software make up a significant portion of the ETF’s portfolio, which is 81.6% concentrated in the Information Technology sector.

The Cybersecurity Landscape and Investment Outlook

Despite recent underperformance, the cybersecurity thesis remains robust. The emergence of AI-enabled attacks, where autonomous systems identify and exploit weaknesses, poses new challenges for businesses. However, security spending is on the rise, with enterprises increasingly prioritizing investments to combat these advanced threats.

The ETF’s top holdings reflect a diverse approach to cybersecurity, combining both cloud-native and network security solutions. The equal-weight structure of the ETF allows for potential recovery among lagging stocks, depending on market performance in 2026.

Investors should watch for key indicators in early 2026, particularly during January and February earnings calls. Announcements regarding enterprise IT budgets will be crucial. If CFOs emphasize cybersecurity investments in light of increasing AI-driven threats, it could signal positive momentum for the sector.

Execution Quality as a Key Factor

Another critical aspect to monitor is the execution quality of the companies within the ETF. In a market that demands perfection, firms need to consistently meet or exceed expectations related to billings, guidance, and customer growth. Regularly checking quarterly earnings releases and investor presentations will provide insight into how well these companies are navigating the current landscape.

For those seeking an alternative investment, the First Trust NASDAQ Cybersecurity ETF (NASDAQ:CIBR) may offer broader exposure with less volatility. CIBR has a longer track record since its inception in 2015 and provides deeper liquidity, potentially smoothing out the impact of individual stock performance.

The acceleration of cybercrime presents both challenges and opportunities for investors. The key to success in 2026 will hinge on whether cybersecurity companies can deliver the flawless execution demanded by the market. As such, the Global X Cybersecurity ETF remains a compelling option for those looking to capitalize on the growing importance of cybersecurity in an increasingly digital world.