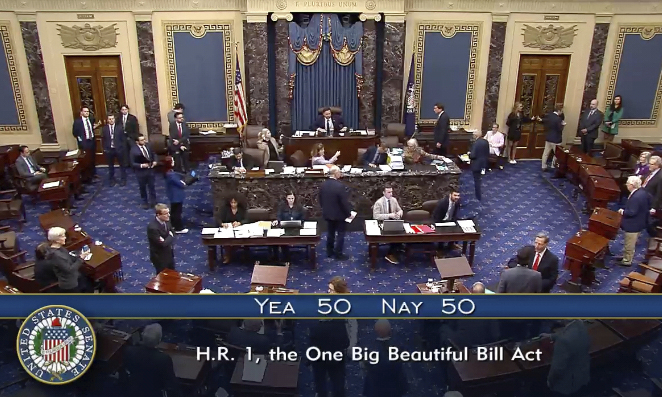

In this image from video from Senate Television, Vice President JD Vance, seated center, breaks a 50-50 tie to push President Donald Trump’s big tax breaks and spending cuts bill over the top, on the Senate floor at the U.S. Capitol, Tuesday, July 1, 2025, in Washington. (Senate Television via AP)

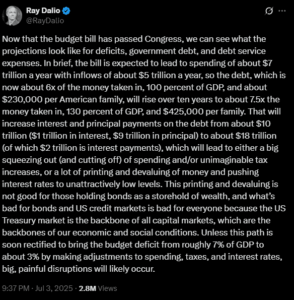

WASHINGTON (NEXSTAR) – In a dramatic conclusion to a 27-hour legislative marathon, the Senate passed President Donald Trump’s controversial bill, often referred to as his “big, beautiful bill,” with Vice President JD Vance casting a rare tie-breaking vote. The bill, which had narrowly passed the House, now returns there for further deliberation as some Senate amendments face opposition among House members.

The bill’s passage marks a significant legislative victory for President Trump, featuring a permanent extension of the 2017 tax cuts, the elimination of taxes on tips, and a substantial $350 billion allocation for border security. Despite these measures, the bill has sparked intense debate, particularly concerning its fiscal implications and social impacts.

Contentious Provisions and Political Divide

Throughout Monday and into Tuesday, Senators engaged in heated discussions and votes on various amendments to the bill. Ultimately, three Republican senators—Rand Paul, Susan Collins, and Thom Tillis—broke ranks to vote against it. Senator Rand Paul criticized the bill for failing to reduce spending as intended, warning that it would instead add $270 billion to the national debt in the upcoming year.

Meanwhile, Senators Collins and Tillis expressed concerns over significant cuts to Medicaid, a point of contention that resonated with every Democrat in the Senate, all of whom voted against the bill. The Congressional Budget Office (CBO) provided a stark assessment, projecting that the bill would reduce federal spending by $1.5 trillion over the next decade but at the cost of 12 million Americans losing Medicaid coverage.

The Congressional Budget Office estimates the bill would cut $1.5 trillion in federal spending over the next ten years, with 12 million Americans potentially losing Medicaid coverage.

Historical Context and Expert Opinions

The bill’s journey through Congress has been fraught with challenges, reflecting a broader historical pattern of contentious fiscal legislation in the United States. The 2017 tax cuts, which this bill seeks to make permanent, were themselves a source of significant debate, with critics arguing they disproportionately benefited the wealthy.

Economic experts have weighed in on the bill’s potential impacts. Dr. Linda Carson, a professor of economics at Georgetown University, noted, “While the tax cuts might stimulate some economic growth, the loss of Medicaid coverage for millions could have severe social repercussions, increasing inequality and straining public health systems.”

Moreover, the allocation of $350 billion for border security has reignited discussions on immigration policy and national security priorities. Proponents argue it is essential for safeguarding the nation, while opponents view it as an excessive expenditure that diverts funds from critical domestic programs.

Next Steps and Potential Consequences

With the Senate’s changes, the bill now returns to the House, where its fate remains uncertain. Some House members have already voiced their dissatisfaction with the amendments, particularly those affecting social welfare programs. The House must now reconcile these differences, a process that could lead to further negotiations or even a potential stalemate.

The implications of the bill’s passage are profound, potentially reshaping the fiscal landscape of the United States for years to come. As lawmakers grapple with the bill’s provisions, the broader debate over fiscal responsibility, social equity, and national priorities continues to unfold.

As the legislative process advances, the nation watches closely, aware that the outcomes will have lasting effects on the economy, healthcare, and the social fabric of the country. The coming weeks will be critical in determining whether the bill becomes law or if further revisions are necessary to achieve a broader consensus.