Meta Platforms Inc. has embarked on a groundbreaking energy procurement initiative, securing agreements that could deliver up to 6.6 gigawatts of nuclear power to support its expanding artificial intelligence infrastructure. Announced on January 9, 2026, these agreements involve prominent energy firms including Vistra Corp., TerraPower LLC, Oklo Inc., and Constellation Energy Corp.. This strategic move positions Meta as a key player in revitalizing U.S. nuclear capabilities amid rising electricity demands driven by AI innovations.

The agreements outline long-term power purchases from three existing Vistra nuclear plants located in the heartland of the United States, along with development support for advanced small modular reactors from TerraPower and Oklo. Meta describes these pacts as “landmark agreements” that will not only enhance plant operations but also foster advancements in nuclear technology and create jobs in local communities.

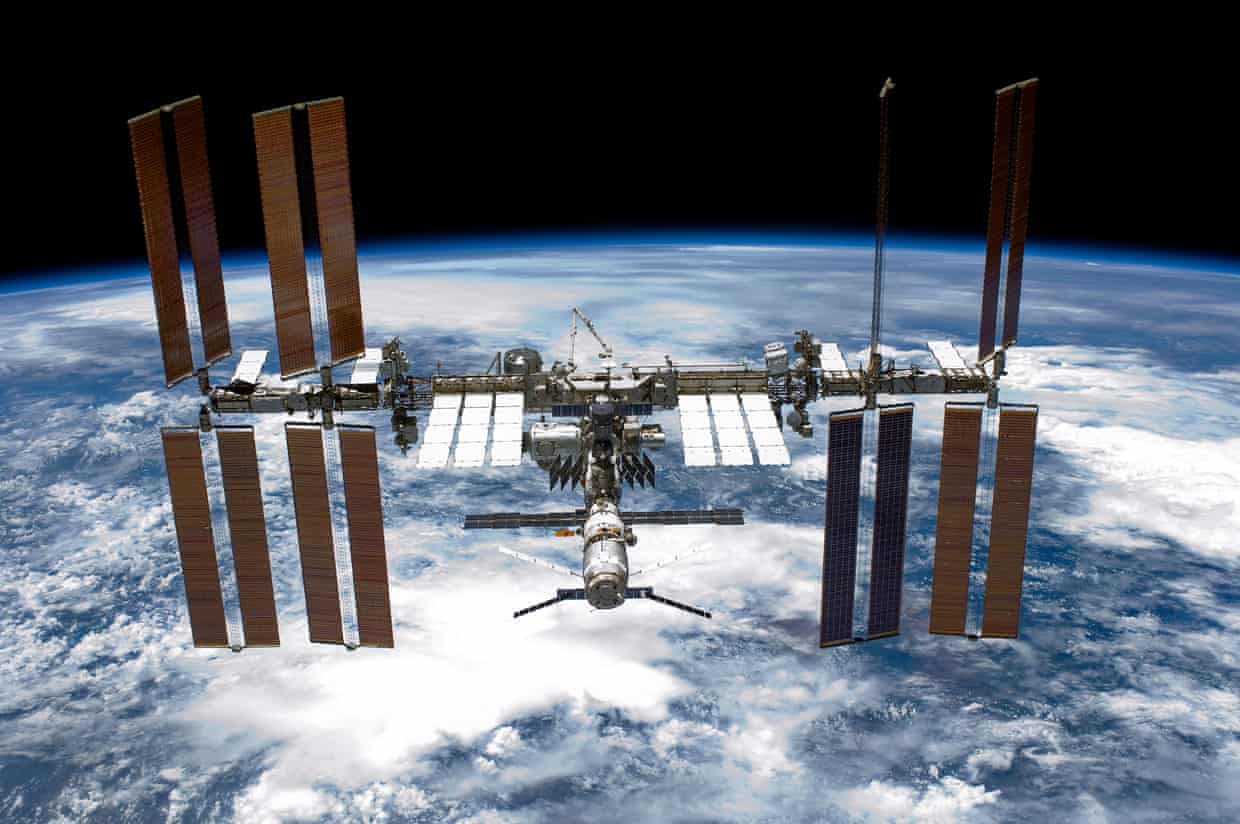

As demand for AI infrastructure surges, the energy requirements for training and inference workloads have escalated significantly. Meta’s upcoming Prometheus AI supercluster aims to push the boundaries of model scale and demands a reliable source of carbon-free baseload power, which intermittent renewable sources cannot fully provide. Industry analysts project that by 2030, U.S. data centers could account for 8% of the nation’s electricity consumption.

Details of the Agreements

Meta’s agreements with Vistra include 20-year power purchase deals for energy generated from nuclear plants in Illinois, Pennsylvania, and Texas, which will extend the operational life of these facilities. Additionally, Constellation, recognized as the largest nuclear operator in the U.S., is participating in capacity expansion efforts. Meta executive Joel Kaplan emphasized the significance of these agreements, stating that they position Meta as “one of the most significant corporate purchasers of nuclear energy in American history.”

The partnerships with TerraPower, backed by Bill Gates, and Oklo, supported by Sam Altman, focus on next-generation reactors. These small modular designs promise quicker deployment times and reduced costs. Meta’s commitments also include funding for site development and licensing, facilitating projects that are expected to launch in the late 2020s.

The announcement from Meta has had substantial market implications. Following the news, Vistra’s share price surged by 16%, reflecting investor enthusiasm for the revival of nuclear energy.

Strategic Implications and Market Reactions

Joel Kaplan articulated the broader implications of these agreements on social media, stating, “Our agreements with Vistra, TerraPower, Oklo, and Constellation… will help power our AI future, strengthen our country’s energy infrastructure, and provide clean energy.” This statement aligns with national energy priorities and highlights the company’s shift away from reliance on natural gas, as nuclear power offers consistent output unaffected by weather variability.

Vistra’s market capitalization increased by $10 billion in a single day, according to Bloomberg data, showcasing the strong investor interest in the nuclear sector. The technical advantages of the modular reactors being developed also stand out. TerraPower’s Natrium reactor uses liquid sodium coolant, enhancing safety and efficiency, while Oklo’s Aurora microreactors are designed for rapid production and deployment near data centers.

Furthermore, Meta’s involvement in these projects helps mitigate the risks associated with these innovative technologies, which have encountered regulatory and financing challenges.

The tightening of uranium fuel supply chains, along with prices that have doubled since 2023, has raised concerns in the industry. However, Meta’s scale could stabilize the market, potentially encouraging the resumption of mining operations in regions like Wyoming and Utah.

Regulatory and Community Impact

The pro-nuclear policies established during the Trump administration, which include streamlined approval processes by the Nuclear Regulatory Commission, are expected to expedite these projects. Meta’s announcement praised efforts toward “American AI leadership and energy dominance,” reflecting a bipartisan consensus on the role of nuclear energy in achieving net-zero emissions goals.

Despite the challenges of regulatory risks and debates surrounding waste management, Meta’s financial strength, with $50 billion earmarked for capital expenditures in 2025, positions it well to navigate these issues. Rivals in the tech industry are also making moves into the nuclear space; Microsoft is collaborating with Constellation on the Three Mile Island project, while Google pursues small modular reactor agreements with Kairos Power.

As Meta’s nuclear energy procurement strategy unfolds, it promises not only to meet the energy demands of its AI initiatives but also to create thousands of high-wage jobs in construction, operations, and supply chains. Existing Vistra plants already employ hundreds, and expansions could double that number.

The local opposition to nuclear energy, often rooted in safety concerns, appears to be diminishing as advanced reactor designs gain acceptance. Furthermore, the economic benefits, including increased tax revenues and infrastructure improvements, are expected to bolster community support.

Looking ahead, by 2035, Meta’s nuclear initiatives could potentially offset 20 million tons of CO2 emissions annually when compared to natural gas alternatives, significantly increasing the share of nuclear energy in the U.S. power mix.

This ambitious strategy not only redefines Meta’s energy landscape but also sets a precedent for corporate energy strategies globally, as the tech sector increasingly prioritizes sustainable and reliable energy sources to support its operations.