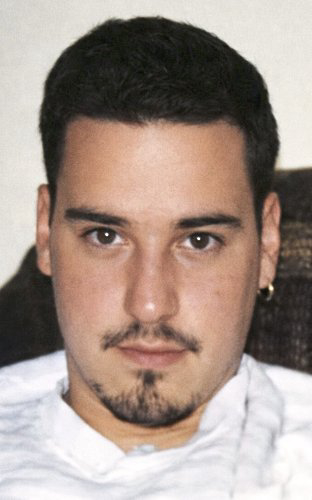

Former President of the First National Bank of Lindsay, Danny Seibel, has been indicted on multiple counts of bank fraud and related offenses. The charges stem from an alleged fraudulent scheme that reportedly operated from February 2007 until Seibel’s termination in September 2024. If convicted, he could face a prison sentence of up to 30 years and fines reaching $1 million, according to a statement from the U.S. Attorney’s Office.

During his time at the bank, Seibel held various management roles, including Chief Financial Officer and Bank Secrecy Act Officer. The indictment outlines serious allegations that he issued unrepaid loans to personal acquaintances while manipulating bank records to conceal these activities. Documents indicate that Seibel made hundreds of unauthorized changes to loan data, actions that were hidden from both the Office of the Comptroller of the Currency (OCC) and the bank’s Board of Directors.

In addition to these offenses, Seibel is accused of neglecting his duty to uphold anti-money laundering programs. Specific charges include failure to report suspicious activities associated with his scheme and allegedly advising clients to keep deposits under $10,000 to evade mandatory reporting requirements. These actions played a critical role in obstructing an OCC examination, wherein he provided false documentation as regulators scrutinized the bank in 2024. Ultimately, these breaches contributed to the bank’s downfall, leading to its receivership ordered by the OCC in October 2024.

Investigation and Legal Proceedings

The indictment was announced by Acting Assistant Attorney General Matthew R. Galeotti, alongside various federal officials. The investigation involves multiple agencies, including the FDIC Office of Inspector General (FDIC-OIG), the Federal Bureau of Investigation (FBI), the Internal Revenue Service Criminal Investigation (IRS-CI), and the Federal Housing Finance Agency Office of Inspector General (FHFA-OIG). The prosecution is being led by Assistant U.S. Attorneys Julia E. Barry and Jackson D. Eldridge, in collaboration with Trial Attorneys Mark Goldberg, Ryan McLaren, and Elysa Wan from the Criminal Division’s Money Laundering, Narcotics and Forfeiture Section. This unit aims to protect financial institutions and the broader economy from internal corruption, as highlighted by the U.S. Attorney’s Office.

It is important to emphasize that an indictment does not equate to a finding of guilt. Seibel is presumed innocent until proven guilty in court. Nonetheless, this case highlights the significant trust placed in leaders of financial institutions and the severe consequences that arise when that trust is compromised. Further details regarding the trial and its progression will emerge as the case develops.