Recent analysis from Energy Aspects emphasizes that the Organization of the Petroleum Exporting Countries (OPEC) is prioritizing strategic policy decisions over market share. This shift has significant implications for global oil prices and the overall economy.

OPEC, a coalition of oil-producing nations, has traditionally aimed to maintain a balance between production levels and market share. However, new insights suggest that the group’s recent decisions are driven more by a desire to stabilize prices than to compete for market dominance. This change in approach has been particularly evident in the context of ongoing production cuts, which aim to bolster falling prices amid a volatile market.

In October 2023, OPEC announced further reductions in oil production, a move that has drawn attention from analysts and market watchers alike. According to Energy Aspects, these cuts are not merely tactical maneuvers but part of a broader strategy to ensure long-term price stability. The organization appears willing to sacrifice market share in favor of maintaining higher price levels, which could ultimately benefit its member countries.

Understanding OPEC’s New Direction

The implications of OPEC’s strategy extend beyond immediate pricing effects. By focusing on policy stability, OPEC aims to create a more predictable environment for both producers and consumers. This approach is particularly crucial as the global economy continues to grapple with supply chain disruptions and fluctuating demand for oil.

Analysts note that this shift may help protect the economic interests of OPEC member states, particularly those heavily reliant on oil revenues. For instance, countries such as Saudi Arabia and Iraq have a vested interest in ensuring that oil prices do not plummet, as such declines could destabilize their economies.

While some market participants have expressed concerns that OPEC’s reduced focus on market share could lead to supply shortages, others argue that the move is essential for long-term viability. The energy sector is currently facing unprecedented challenges, including geopolitical tensions and the transition to renewable energy sources. OPEC’s new strategy may serve to buffer its members against these shifting dynamics.

Market Reactions and Future Outlook

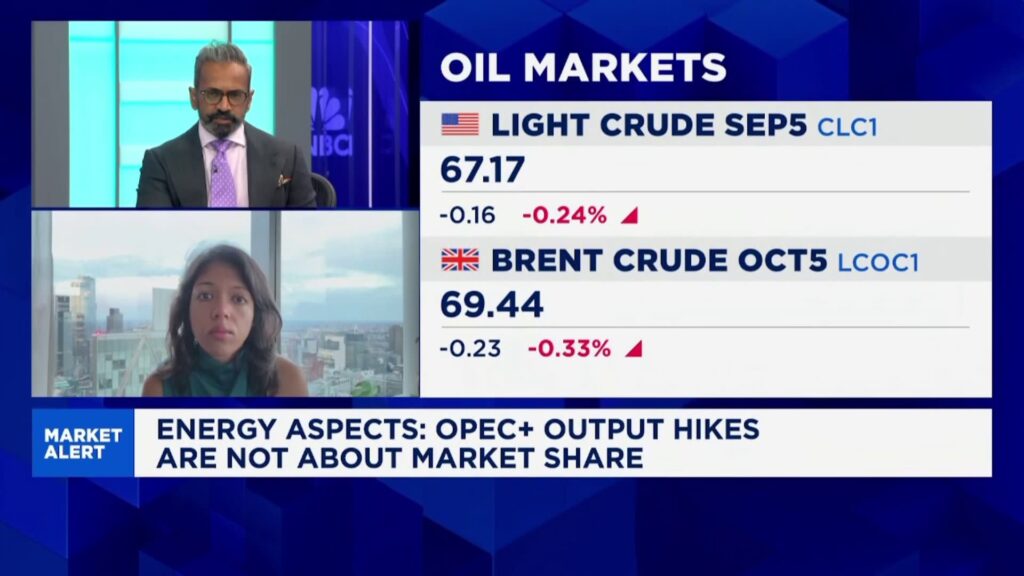

The initial market response to OPEC’s ongoing production cuts has been cautiously optimistic. Oil prices saw a modest increase following the announcements, indicating that investors are starting to factor in the potential benefits of a more stable pricing environment. As of now, the price of Brent crude oil has hovered around $90 per barrel, a level that many analysts believe is sustainable given the current production levels.

Looking ahead, the implications of OPEC’s strategy will continue to unfold. Observers will closely monitor how member countries adapt to this new focus and whether the anticipated stability will materialize in the face of ongoing challenges.

In summary, OPEC’s shift away from an emphasis on market share towards a policy-driven approach has the potential to reshape the oil landscape. With global economic factors at play, the organization is navigating a complex environment that will require careful management and strategic foresight.