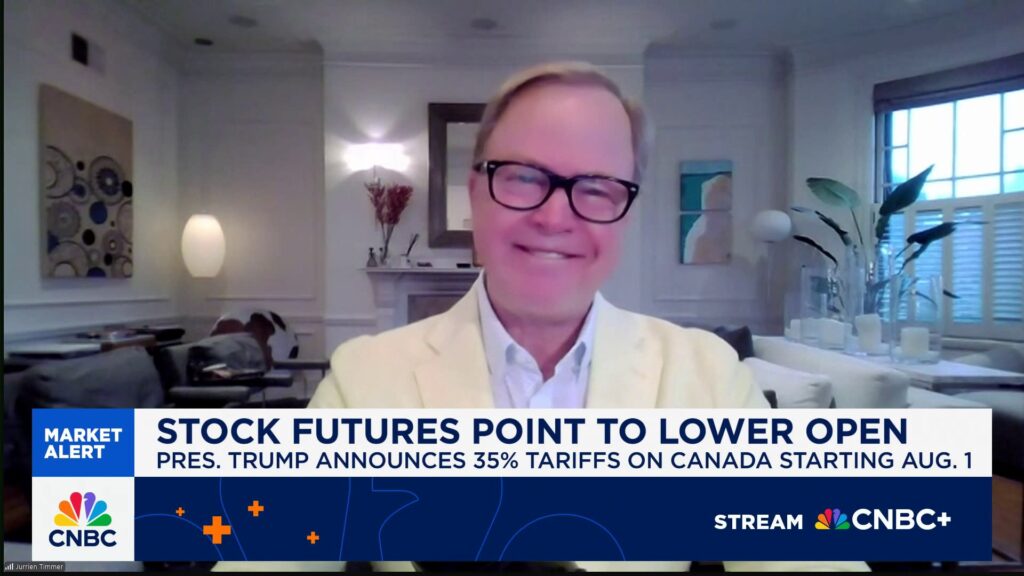

Jurrien Timmer, the director of global macro at Fidelity Investments, expressed optimism regarding the current state of the equity market during an appearance on the financial program Squawk Box. Timmer provided insights on the strength of equities, the status of the bond market, and various economic indicators that shape market performance.

In his discussion, Timmer emphasized that the overall health of the equity market remains robust. He noted that despite various challenges, including rising interest rates and geopolitical tensions, the fundamentals supporting stock prices are sound. “The underlying economic growth is still there,” he stated, underscoring that corporate earnings have continued to exhibit resilience.

Market Dynamics and Future Outlook

Timmer elaborated on the dynamics between equity and bond markets, explaining that while equities are showing strength, the bond market has faced fluctuations. He pointed out that the recent rise in yields has influenced investor behavior. The bond market’s adjustments are a response to inflationary pressures and the Federal Reserve’s monetary policy, which aims to navigate these economic uncertainties.

He also discussed the implications of these market conditions for investors. “It’s essential to remain diversified,” he advised, indicating that a balanced approach can help mitigate risks associated with market volatility. Timmer’s insights reflect a broader understanding of how interconnected these financial markets are, and how they can impact investor decision-making.

Investment Strategies Amid Changing Conditions

Investors are currently faced with a complex landscape as they evaluate their portfolios. Timmer highlighted the importance of focusing on sectors that may outperform in this environment. He mentioned technology and healthcare as areas that could provide growth opportunities, given their potential to adapt and thrive amid economic changes.

As the discussion continued, Timmer acknowledged the potential challenges that could arise in the near future. He cautioned that while the equity market is in good health, unexpected events could still create volatility. Therefore, staying informed and agile in investment strategies is crucial.

In conclusion, Jurrien Timmer’s analysis on Squawk Box serves as a reminder of the importance of understanding market fundamentals. With a clear perspective on the resilience of the equity market and the complexities of the bond market, investors are encouraged to take a strategic approach to their financial planning in the coming months.