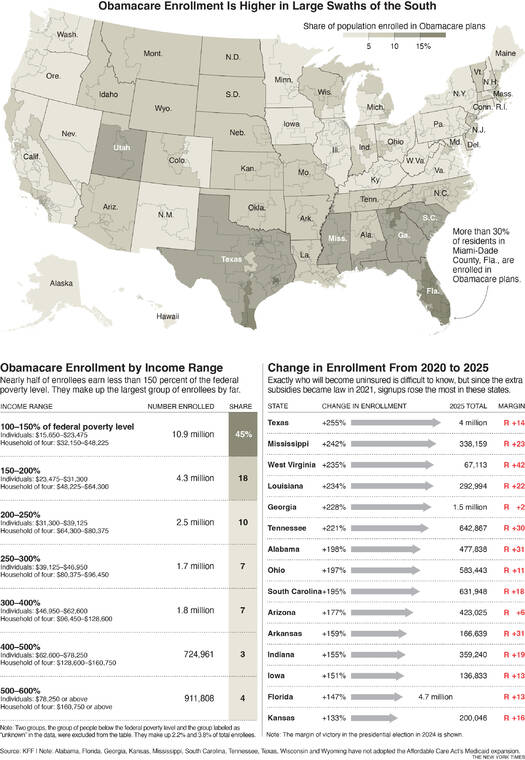

Over 23 million Americans currently enrolled in Affordable Care Act (ACA) plans face potential increases in health care costs starting next year. This change is contingent on whether additional federal funding for subsidies is extended before its expiration on December 31, 2023. Congressional Democrats are leveraging their votes on a government spending bill to push for the continuation of these subsidies, which significantly lower insurance costs for individuals purchasing health coverage through ACA marketplaces.

The ACA was initially designed to provide Medicaid coverage to the poorest Americans while offering financial assistance to those with slightly higher incomes. However, states that have declined to expand Medicaid under the ACA, particularly in Republican-led areas, have seen a marked impact. A significant 57% of those benefiting from these subsidies live in Republican congressional districts, revealing a stark contrast in health coverage availability based on state decisions regarding Medicaid expansion.

Enrollment in ACA plans has surged since the introduction of additional funding in 2021, particularly in states that have not expanded Medicaid. In the six states—Texas, Louisiana, Mississippi, Tennessee, Georgia, and West Virginia—that have seen substantial enrollment growth, the overall number of participants has more than tripled. Notably, West Virginia and Louisiana are exceptions as they have opted to expand their Medicaid programs.

The impact of ACA coverage is especially pronounced in regions like South Florida, where a high concentration of low-wage workers and early retirees rely on these plans. Many enrolled individuals earn less than 150% of the federal poverty level, equating to around $24,000 for an individual or $48,000 for a family of four. These individuals often work in low-wage jobs without health insurance benefits or are freelancers engaged in gig work.

For this demographic, the ACA subsidies are particularly robust. Eligible consumers can select one of the two lowest-cost plans available in their market, allowing them to forego monthly premium payments entirely. Critics argue that the generosity of these subsidies may create opportunities for fraud. Should the subsidies expire, individuals in this income bracket could see their monthly premium costs rise to between $27 and $82.

As negotiations continue in Washington, the expiration of these subsidies could significantly alter the landscape of health care access for millions of Americans. The ongoing discussions underscore the importance of these financial supports, especially for those in states that have not expanded Medicaid, and highlight the broader implications for health care affordability nationwide.