Maryland’s economy is currently facing significant challenges, exacerbated by a combination of federal pressures, legislative policies, and growing resident pessimism. A recent analysis from the Federal Reserve Bank of Philadelphia highlights the state’s precarious fiscal position, revealing that Maryland experienced a notable economic decline. According to the August 2025 State Coincident Index, while most U.S. states showed signs of modest growth, Maryland stood out with a stark decline, indicated by a glaring orange hue on the economic map.

Political leaders in Maryland have largely attributed these economic difficulties to federal actions, including policies initiated by former President Donald Trump and tech entrepreneur Elon Musk. However, the roots of Maryland’s economic issues can be traced back to prior decisions made at the state level. In March 2023, Comptroller Brooke Lierman warned of underperformance in the state’s economy, noting that Maryland was lagging behind the national economy in terms of employment and consumer spending. Despite her urgent message, state leaders did not take the necessary steps to address the situation.

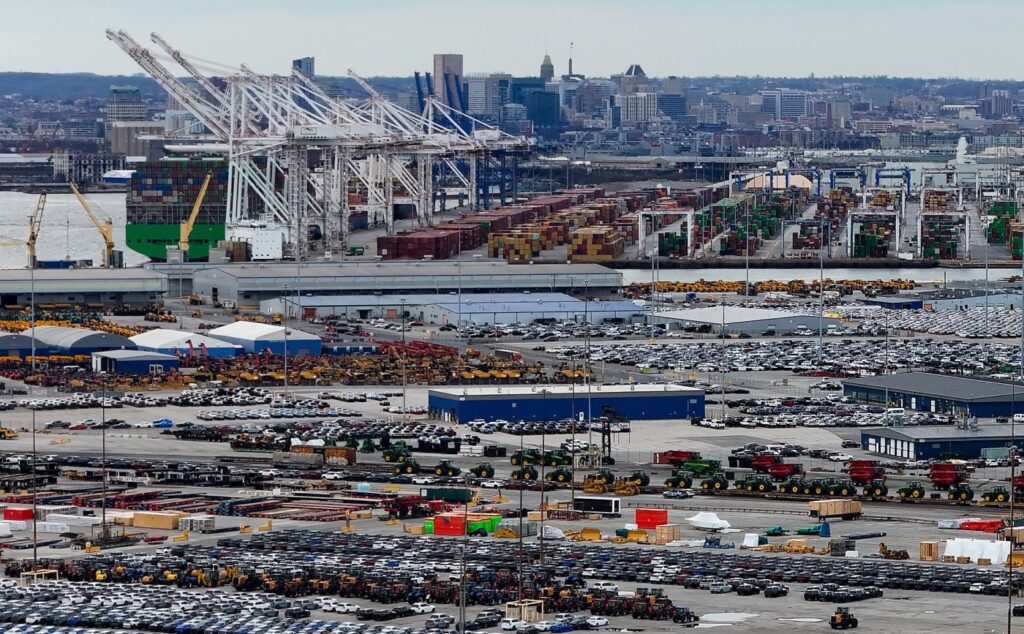

The impact of federal employment on Maryland’s economy cannot be overlooked. The state relies heavily on federal jobs, with federal workers comprising over 5% of the workforce, compared to a national average below 2%. Since the current administration took office, Maryland has suffered the highest rate of federal job losses in the nation, with 15,100 jobs eliminated as reported by the Maryland Department of Labor.

While federal policies have certainly played a role, Maryland’s economic woes are also a result of decisions made within the state government. In the current legislative session, the General Assembly approved over $1.6 billion in new taxes and fees, many of which directly target business creators and employment hubs. Among these are the renewed “millionaire tax” and the contentious “IT tax.” Coupled with steep fee hikes in areas such as vehicle registration, these measures have created a burdensome environment for residents and businesses alike.

The necessity for these new taxes stemmed from the need to address a projected $3 billion deficit. However, this deficit has roots in past legislative decisions, such as the commitment to invest $30 billion over ten years through the Blueprint for Maryland’s Future education plan. The financial strain from these commitments should have been anticipated and addresses the broader issue of state fiscal management.

Maryland’s leaders are now challenged to reassess their strategies. While external pressures are indeed significant, the state’s fiscal difficulties were not predestined. There is an urgent need to focus on creating a more business-friendly environment that attracts and retains job creators. State leaders must ask themselves how they can better support economic growth and stability.

By prioritizing a collaborative approach to economic policy, Maryland can work towards reversing its current trajectory. With a focused and committed effort, the state has the potential to restore its reputation for resilience in the face of economic adversity.