The phenomenon known as the Santa Claus rally has captured the attention of investors as a period of stock market gains typically observed during the last week of December. This year, optimism is particularly high due to increased consumer spending and the expected impact of holiday bonuses. Financial analysts note that such rallies can set a positive tone for the coming year, making this a crucial time for market participants.

The Santa Claus rally refers to a rise in stock prices during the final days of December, often attributed to heightened investor enthusiasm. According to research from the National Bureau of Economic Research, this trend has been observed in various years, with significant gains recorded in many stock indices. Investors often look to this period as an opportunity to capitalize on the seasonal uptick in consumer spending.

Understanding the Factors Behind the Rally

One of the primary drivers of this rally is the boost in consumer spending that occurs during the holiday season. As shoppers flock to stores and online platforms, retailers experience a surge in sales. In December 2023, retail sales are projected to increase by 5.5% compared to the previous year, according to data from Statista. This growth is largely fueled by holiday shopping and the disbursement of year-end bonuses to employees.

Furthermore, many consumers are likely to invest their bonuses into the stock market, further propelling stock prices upward. The Wall Street Journal reported that approximately 70% of employees plan to allocate a portion of their bonuses towards investments, underscoring the confidence many have in the market’s performance.

Historical Context and Future Implications

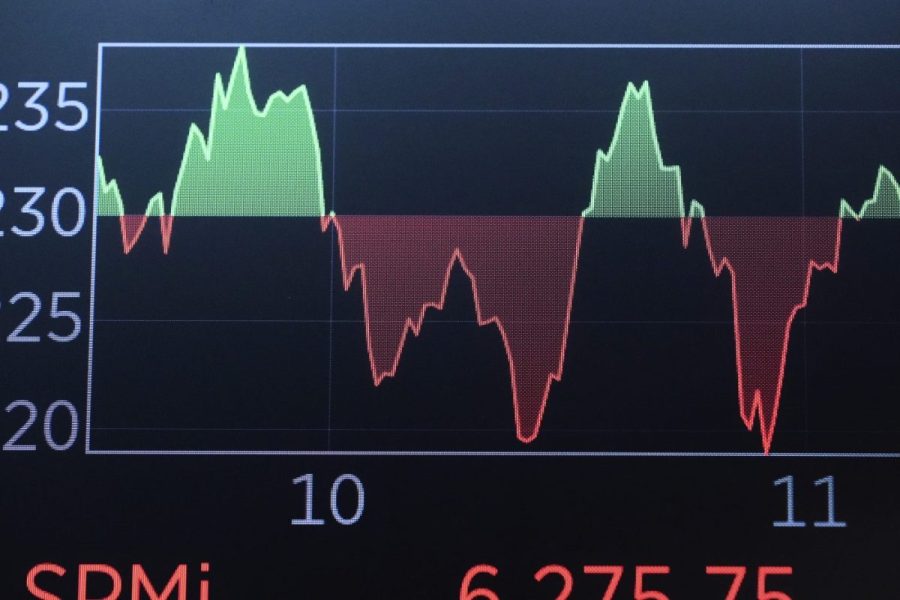

Historically, the Santa Claus rally has shown a consistent pattern of positive returns. For instance, in the last decade, the S&P 500 has recorded an average gain of 1.3% during this period. Such trends prompt investors to reflect on historical data when making decisions about their portfolios. In 2022, the S&P 500 rose by 2.5% during the same timeframe, highlighting the potential for significant returns.

As December 2023 progresses, market analysts will be closely monitoring consumer behavior and stock performance. The interplay between increased spending and stock market growth could serve as a barometer for economic health in the upcoming year. With many investors optimistic about the Santa Claus rally, this period may provide crucial insights into future market trends.

In summary, the Santa Claus rally represents more than just a seasonal uptick in stock prices; it reflects broader economic sentiments and the impact of consumer behavior. As investors prepare for the final trading days of December, the combination of holiday spending and bonus-driven investments could lead to notable market activity, setting the stage for 2024.