Ford Motor Company announced a significant shift in its electric vehicle strategy with the unveiling of its Universal EV Platform in August 2025. The company has committed $5 billion to this initiative, which aims to produce affordable electric vehicles at scale. During the presentation, CEO Jim Farley characterized this moment as Ford’s “Model T moment,” emphasizing the need for simplified manufacturing processes and domestically produced lithium iron phosphate (LFP) batteries.

Farley faced the audience with a candid acknowledgment of the challenges ahead. He stated that while the investment is substantial, there are no guarantees of success, highlighting the inherent risks in pursuing such a bold strategy amid a changing policy landscape. The company is banking on innovations in cost-cutting and a potential shift in U.S. political priorities that would once again favor electrification.

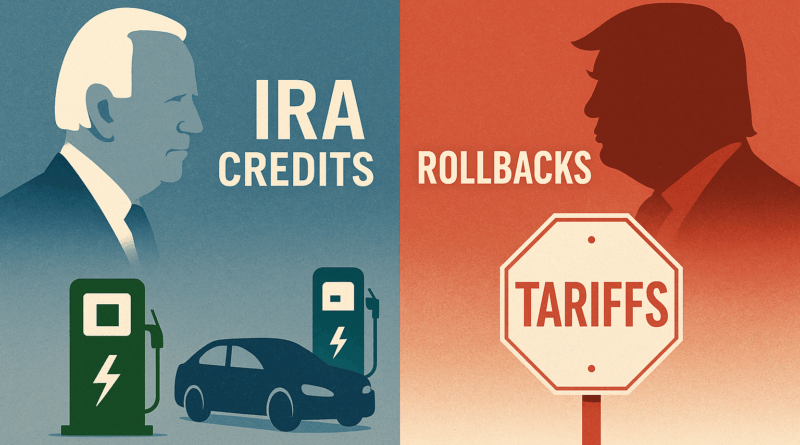

The concept of a sound strategy, as outlined by Richard Rumelt, requires a clear diagnosis of the situation, a guiding policy, and coherent actions. In the years leading to this pivotal moment, Ford appeared to have a strong diagnosis. The groundwork for the platform began in 2022 at a California skunkworks, outside the traditional Ford development framework. By 2024, the company’s commitment coincided with the Biden administration’s Inflation Reduction Act, which provided incentives for electric vehicle purchases and investments in charging infrastructure.

Under these supportive conditions, Ford’s investment in a flexible, high-volume, low-cost EV architecture seemed logical. The goal was clear: to create a line of affordable EVs manufactured with fewer parts, enabling faster assembly and reduced costs due to locally produced batteries.

However, the political landscape has shifted dramatically since then. The current administration has discontinued the $7,500 consumer EV credit, reduced funding for charging infrastructure, and imposed 50% tariffs on imported steel and aluminum. These changes have raised the effective consumer prices of electric vehicles, slowed the expansion of charging networks, and increased raw material costs.

As a result, Ford’s ambitious plan faces significant headwinds. Should these policies remain in place, the economic rationale that supported the original investment may falter. The American market may continue to be sensitive to price and apprehensive about short-range electric vehicles, particularly given the country’s vast distances between urban centers and inconsistent charging coverage.

Despite these challenges, Ford’s management appears optimistic. They seem to be banking on a short-lived political environment, hoping for a return of supportive policies similar to those under the previous administration. The company is continuing to invest in tooling, battery plants, and supplier commitments, signaling a coherent choice based on internal assessments that policy will shift back to favor EV adoption before the new vehicles reach full production.

From an engineering perspective, the Universal EV Platform presents several innovative features. It boasts structural LFP battery packs produced in Michigan to cut costs, a revamped assembly process that allows for parallel construction of vehicle modules, and a simplified wiring architecture aimed at reducing weight and failure points.

Nevertheless, the platform’s base battery capacity of approximately 51 kWh raises concerns. While it may suffice in regions with shorter commutes, it may not meet the expectations of American consumers accustomed to long-distance travel. The lack of a robust charging infrastructure could limit the vehicle’s appeal in the U.S. market.

Internationally, the platform faces additional hurdles. The dimensions of these North American-sized vehicles are not well-suited for many European roads and parking spaces. They will also encounter stiff competition from manufacturers like BYD, which offer higher-quality electric vehicles with superior range at competitive prices.

The Universal EV Platform does hold promise in the commercial vehicle sector, where total cost of ownership is a critical factor for purchasing decisions. Fleet operators in utilities, delivery services, and municipal services could benefit from the platform’s cost-effective manufacturing and locally sourced components. The ability to adapt the platform for various work-focused designs could meet the needs of operators who prioritize lower maintenance costs and predictable energy expenditures.

As Ford moves forward with this ambitious plan, competitors are not standing still. Tesla is preparing to introduce a basic version of its Model Y, while General Motors is targeting the affordable crossover market with its Ultium-based Equinox EV. Other manufacturers, including Toyota and Stellantis, are also working on their own electric offerings.

In this high-stakes environment, Ford’s strategy reflects a calculated risk. If political conditions shift back in favor of electric vehicle incentives and infrastructure support, the Universal EV Platform could find a receptive market. Conversely, if current challenges persist, the company may struggle to sell short-range vehicles at competitive prices, particularly in a landscape where rivals are offering longer-range options.

The alignment of diagnosis, guiding policy, and coherent actions was evident when Ford made its initial bet. However, with the current diagnosis changing, the company’s continued commitment may either demonstrate admirable persistence or set the stage for a strategy that ultimately falls short. Execution will be critical as the automotive landscape evolves in the coming years.