The Capital Group Growth ETF (NYSEARCA: CGGR) has garnered attention as retirees contemplate investment choices for 2026. With a focus primarily on growth, CGGR’s characteristics raise critical questions about its viability as a source of income for those in retirement.

Growth-Focused Strategy Lacks Income Generation

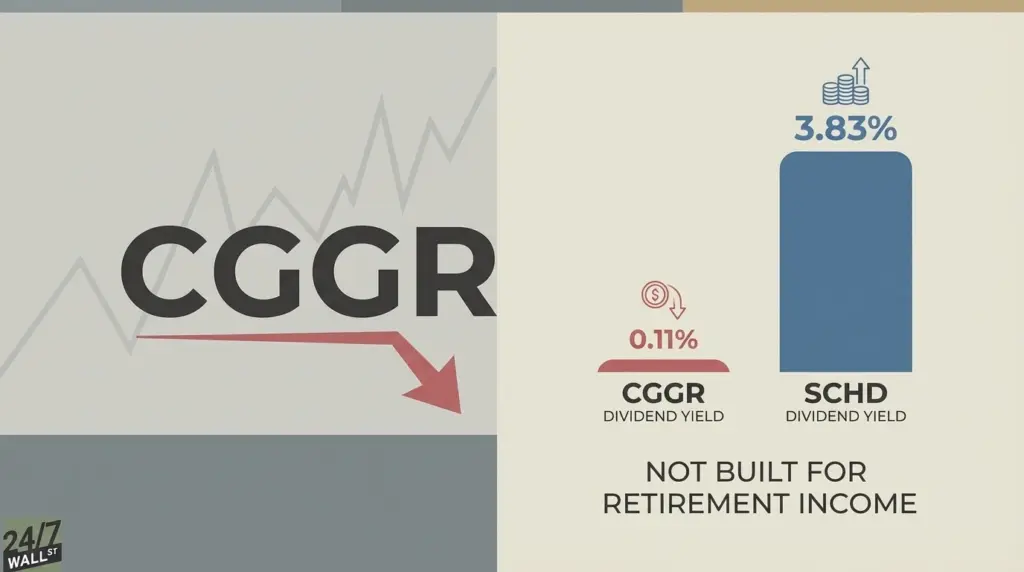

CGGR’s portfolio demonstrates a substantial commitment to growth sectors, with over 57% of its assets allocated to Information Technology, Communication Services, and Consumer Discretionary. This allocation prioritizes capital gains over generating income through dividends, making it less suitable for traditional retirement portfolios. The fund’s current dividend yield stands at a mere 0.11%, translating to approximately $550 annually on a $500,000 investment. This figure raises concerns, as it barely covers essential monthly expenses such as utilities.

The fund’s distribution for 2025 has notably declined, with a payout of $0.04 per share, reflecting a 65% drop from $0.12 issued in 2024. Such fluctuations indicate a lack of reliability in income generation, which is a primary requirement for retirees needing consistent cash flow.

Volatility and Performance Concerns

Despite CGGR’s focus on growth, its performance thus far in 2025 shows promise, returning 20.9% year-to-date and surpassing the S&P 500 by approximately 3.6% percentage points. Since its inception in February 2022, the fund has consistently outperformed its benchmark through concentrated positions in high-growth companies like Meta Platforms (NASDAQ:META), Tesla (NASDAQ:TSLA), and Nvidia (NASDAQ:NVDA). However, this outperformance comes with significant volatility. Stocks such as Tesla and others have the potential for dramatic price fluctuations, particularly during market downturns, which can jeopardize the stability that retirees often seek.

Investing in CGGR necessitates accepting certain trade-offs. First, retirees may find income generation exceedingly challenging, leading to a reliance on selling shares to cover living expenses. Second, the fund has minimal defensive positioning, with less than 2% allocated to Consumer Staples and under 1% to Utilities. Lastly, with a short track record of just 3.8 years, there is limited data on how CGGR would perform in long-term bear markets or recessions.

Alternatives for Retirees

For retirees prioritizing income over growth, alternatives exist that may better suit their needs. The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is one such option, offering a significantly higher dividend yield of 3.83%, which is approximately 35 times that of CGGR. With $71 billion in assets and a low expense ratio of 0.06%, SCHD focuses on dividend growth from defensive sectors including Energy, Consumer Staples, and Healthcare. The fund has a proven track record, having paid 56 consecutive quarterly dividends since 2011, furnishing retirees with the steady income stream they require.

While CGGR may have a place as a small satellite investment for those with substantial assets who can tolerate concentrated growth exposure, its low yield and volatility starkly contrast with the traditional income needs of retirees.

In conclusion, the Capital Group Growth ETF may prove unsuitable for retirees in 2026, particularly those who rely on their investments for income. As the transition from wealth accumulation to income generation is often overlooked, retirees are encouraged to evaluate their options carefully and consider strategies that align with their financial goals.