EasyStaff Data Reveals 6.8× Growth in Payroll Use of Stablecoins

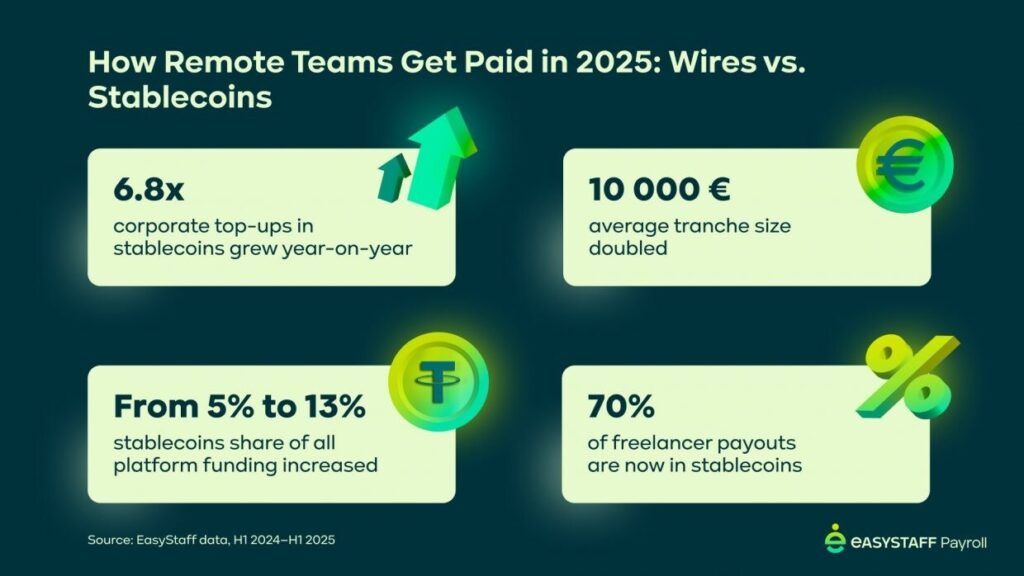

Corporate adoption of stablecoins for payroll has surged dramatically, according to new data from the global B2B payments platform EasyStaff. Released on October 1, 2025, the report reveals a staggering 6.8 times increase in the use of stablecoins for payroll purposes year-over-year. This significant trend illustrates a growing shift among businesses toward digital assets, moving away from traditional banking systems to enhance efficiency in international payments.

The report, which details internal transaction data from the first half of 2025, indicates a marked increase in the average stablecoin deposit by corporations, which more than doubled from €4,700 to €10,000. This 134% surge suggests a strategic move by finance leaders aiming to consolidate payments, minimize transaction fees, and streamline their operations.

Key Insights into Payroll Trends

The findings highlight a notable expansion in the corporate use of stablecoins. The share of stablecoin deposits for B2B transactions rose from 5% to 13% on the EasyStaff platform, marking a significant shift in payment preferences among businesses. The total volume of transactions involving stablecoins nearly tripled, showcasing the acceleration of this trend as companies seek alternatives to legacy systems like SWIFT and SEPA.

Additionally, the data reveals that the contractor economy remains robust, with crypto withdrawals by freelancers stabilizing at nearly 70%. This statistic confirms stablecoins as a preferred payout method, particularly for fast and recurring payments. Nonetheless, larger or taxable disbursements still tend to favor traditional bank transfers, indicating a nuanced approach to payment methods among modern contractors.

The report also uncovers an intriguing trend in hiring practices. There has been a 71% rise in recruitment activity between companies based in the U.S. and UAE and talent from Eastern Europe and Central Asia. This shift suggests that businesses are increasingly tapping into global talent pools, further facilitated by the adoption of digital currencies.

The Future of Payroll with Stablecoins

EasyStaff’s data provides compelling insight into the evolving landscape of payroll management. The growth metrics reported are unprecedented, making this data a crucial reference point for understanding the future of global payroll systems. The concept of a “multi-rail” treasury strategy—integrating the security of wire transfers with the speed and efficiency of stablecoins—has shifted from a theoretical idea to a practical necessity for companies competing in a global marketplace.

The report aligns with broader industry analyses, including insights from FXC Intelligence and McKinsey, which emphasize the increasing mainstream adoption of stablecoins. However, EasyStaff’s findings are unique in quantifying this trend specifically within a payments platform context.

As businesses navigate the complexities of modern finance, the implications of this shift are significant. Companies that adapt to these changes stand to benefit from enhanced payment efficiency and reduced costs, positioning themselves favorably in an increasingly competitive environment.

About EasyStaff: Founded in 2018, EasyStaff is a global service platform that connects businesses with freelancers, remote teams, and international talent through seamless B2B contracts. Operating in over 120 countries, the company serves more than 2,100 businesses and facilitates payments for over 30,000 freelancers worldwide.