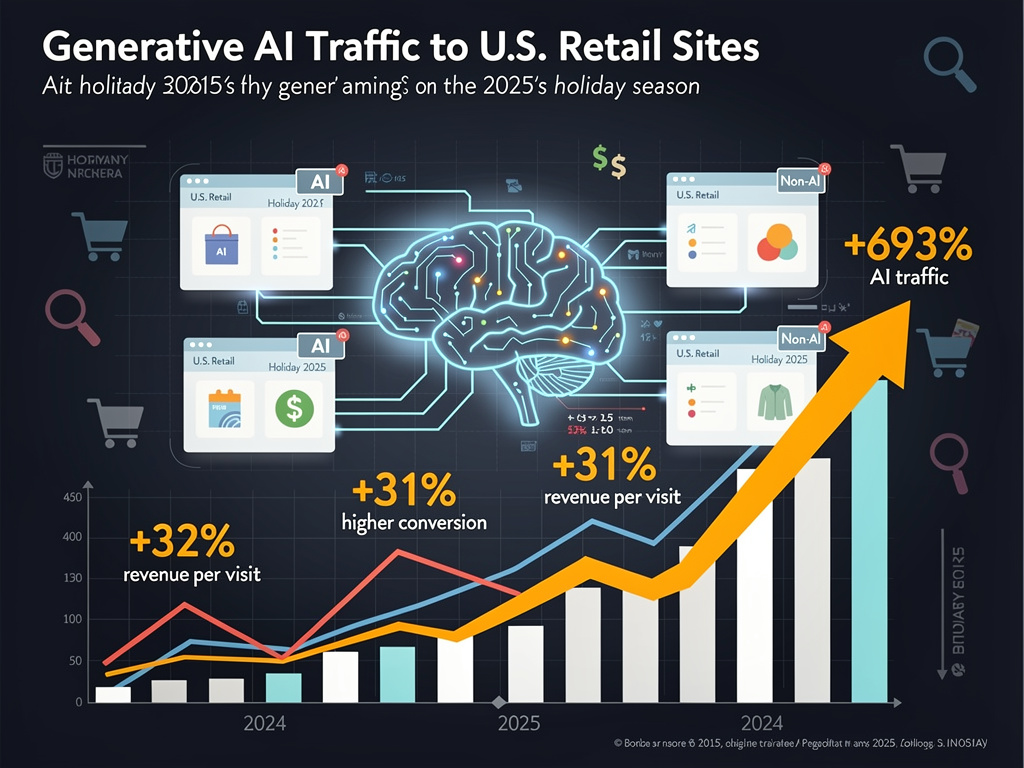

Generative AI tools such as ChatGPT, Gemini, and Perplexity catalyzed a remarkable 693% increase in traffic to U.S. retail sites during the 2025 holiday season, spanning from November 1 to December 31. According to Adobe’s Quarterly AI Traffic Report, the analysis of over one trillion visits to retail websites revealed that AI referrals not only significantly increased site traffic but also outperformed traditional sources in conversion rates.

During this period, traffic generated by AI tools converted at rates 31% higher than non-AI sources overall. The results were even more pronounced on major shopping days, with conversions 54% higher on Thanksgiving and 38% greater on Black Friday. This trend marks a significant shift from 2024, when non-AI traffic outperformed AI by 51% in revenue per visit.

The data indicates a broader transformation in retail dynamics, with AI-sourced visitors driving 32% more revenue per visit compared to previous years. Additionally, engagement metrics soared, with users spending 45% longer on sites and viewing 13% more pages per session. “AI-driven traffic surged across industries, leading to deeper engagement that translates into higher conversions during the 2025 holiday season,” stated Vivek Pandya, director of Adobe Digital Insights.

Record Sales and Expanded Impact

The retail boom was not confined to the holiday period alone. AI referrals also saw triple-digit growth in sectors such as travel (539%), financial services (266%), and technology/software. Total U.S. online holiday sales reached a record $257.8 billion, reflecting a 6.8% increase from $241.4 billion in 2024. The holiday season featured 25 days of spending exceeding $4 billion daily, an increase from 18 days the previous year.

The evolution of AI from a novel tool to a critical revenue driver has accelerated since the previous year’s holiday season, which saw a staggering 1,300% increase in traffic. By mid-2025, revenue per visit from AI sources had increased by 84% compared to earlier months, diminishing the gap to just 27%%. Confirming consumer trust in these channels, a survey revealed that 47% of shoppers expressed confidence in AI-generated results.

Retailers experienced a significant impact from this surge. On Black Friday, AI traffic skyrocketed by 805% year-over-year. Mobile platforms dominated transactions, accounting for 56.4%66.5% on Christmas day. Additionally, the buy-now-pay-later sector recorded $20 billion in transactions, a growth of 9.8% from the previous year.

Demographic Trends and Geographic Disparities

Demographic analysis indicates high-income states such as Virginia, Washington, New York, California, and Massachusetts generated AI engagement levels double the national average, accounting for 52% of U.S. AI traffic. Urban consumers showed a keen awareness of AI tools, with 80% reporting knowledge of AI assistants and 48% actively using them for shopping. Conversely, rural areas lagged significantly in adoption rates.

Despite high online activity in states like Mississippi, AI engagement proved low, highlighting disparities in digital commerce. Nationally, only 2% of consumers reported being unaware of AI assistants. A further 46% had used them for shopping, with 58%88% of participants stating they had utilized AI during the 2025 season. Notably, 56% reported greater satisfaction due to AI assistance, and 69%Deloitte indicated that 33% of consumers planned to use generative AI, doubling from the previous year, while 26%Perplexity and Claude are gaining traction for consumer research, deal-hunting, and gift ideas. Adobe noted a significant uptick in prompts for popular categories, such as mobile phones and toys, during critical shopping periods.

Marketers are responding to this shift, with 75% of them planning to integrate AI for promotional deals, an increase from 66%25-fold increase in usage.

As businesses strategize for the future, challenges remain, including high return rates of 28%, which strain profit margins. Nonetheless, the momentum surrounding AI—projected to see pre-holiday growth of 520%—positions it as a significant battleground in retail.

The comprehensive data collected by Adobe from 215 leading retailers highlights the critical need for optimization. Bounce rates have decreased as relevance increased, with desktop platforms maintaining dominance in AI traffic at 86%58%NVIDIA—noted for their cost reductions of 95%Vivek Pandya. The era of AI in retail has firmly established itself, reshaping the future of commerce.