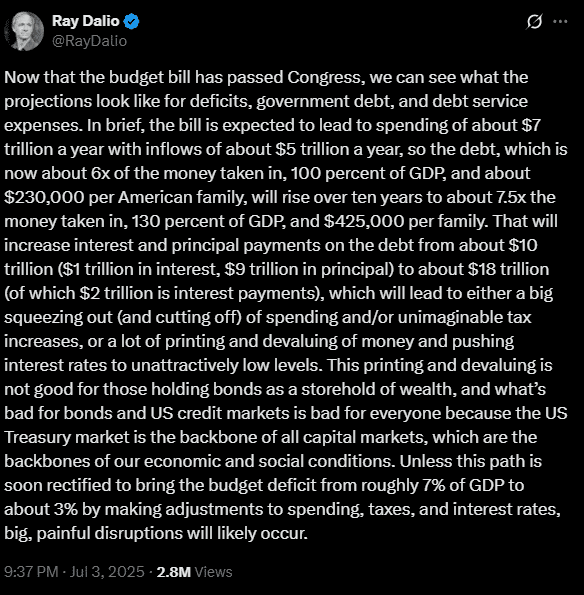

As the U.S. grapples with its escalating debt, financial experts and crypto enthusiasts are turning their attention to Bitcoin (BTC) as a potential safe haven. This conversation gained momentum following the recent passage of a tax and spending bill projected to add over $3 trillion to the national debt over the next decade. Hedge fund titan Ray Dalio has sounded the alarm, warning that this could lead to a devaluation of wealth tied to the U.S. dollar.

Dalio, founder of Bridgewater Associates, cautioned that the burgeoning debt could become unmanageable, placing an unsustainable burden on American families. He highlighted potential outcomes such as higher taxes, reduced government spending, or increased money printing, all of which could undermine the dollar’s value. “This printing and devaluing is not good for those holding bonds as a storehold of wealth, and what’s bad for bonds and US credit markets is bad for everyone,” Dalio stated.

Bitcoin: A Hedge Against Fiscal Chaos?

In the wake of Dalio’s warnings, crypto leaders have pointed to Bitcoin as a viable hedge against fiscal instability. The digital currency, with its fixed supply, stands in stark contrast to the traditional fiat currencies like the U.S. dollar, which can be printed at the discretion of central banks. This characteristic makes BTC, along with gold and other scarce commodities, attractive as a store of value.

Matt Hougan, CIO of Bitwise, responded to Dalio’s concerns by urging investors to consider Bitcoin. Similarly, Raoul Pal of Real Vision emphasized the role of tech and crypto as superior hedges in a devaluation scenario. “Debasement hedges in secular bull markets – there are only two that significantly outperform: tech and crypto,” Pal asserted.

Gold vs. Bitcoin: A Divergence in Views

While Dalio acknowledges owning some Bitcoin, he remains more inclined towards gold, citing its easier price tracking, especially during geopolitical conflicts. Conversely, BlackRock’s Larry Fink has described Bitcoin as “digital gold,” suggesting that it could potentially replace the U.S. dollar as the world’s reserve currency if the fiscal debt remains unchecked.

Despite these endorsements, not everyone shares the same level of concern. Treasury Secretary Scott Bessent has downplayed the debt worries, asserting, “We are growing GDP faster than debt, and that trend will continue through the remainder of the President’s term.”

Market Implications and Future Outlook

Meanwhile, analysts at Coinbase have raised concerns about the implications of the spending bill, which includes a $5 trillion increase in the debt limit. They warn that the U.S. Treasury’s efforts to replenish its Treasury General Account (TGA) could drain liquidity from the market, posing a risk to all risk assets, including Bitcoin. “This TGA replenishment could potentially drain liquidity from the broader market in the short term, posing a notable downside risk for all risk assets,” they noted.

The debate over Bitcoin’s role as a hedge against fiscal instability continues to evolve. As the U.S. navigates its debt challenges, the cryptocurrency’s fixed supply and decentralized nature may offer an attractive alternative for those seeking to preserve wealth. However, the market remains volatile, and investors must weigh the potential risks and rewards carefully.

As the fiscal landscape shifts, the conversation around Bitcoin and its place in the global financial system is likely to intensify. Whether it will emerge as a dominant store of value or remain a speculative asset will depend on how these economic dynamics unfold in the coming years.