The State of Michigan Retirement System has raised its stake in Intel Corporation (NASDAQ: INTC) by 0.3% during the first quarter of 2024. This increase was confirmed in a recent disclosure to the Securities and Exchange Commission. Following its acquisition of an additional 4,100 shares during this period, the retirement system now holds 1,560,483 shares, valued at approximately $35,439,000.

Several other large investors have also recently adjusted their positions in Intel. Notably, Vermillion Wealth Management Inc. initiated a new stake in the company valued at $27,000 in the fourth quarter of 2023. Similarly, LFA Lugano Financial Advisors SA and Olde Wealth Management LLC purchased new stakes worth $30,000 and $31,000, respectively, during the first quarter of 2024. Conquis Financial LLC and Mizuho Securities Co. Ltd. also entered the fold with stakes valued at $32,000 each.

As of now, institutional investors and hedge funds collectively own 64.53% of Intel’s stock, indicating strong institutional interest in the company.

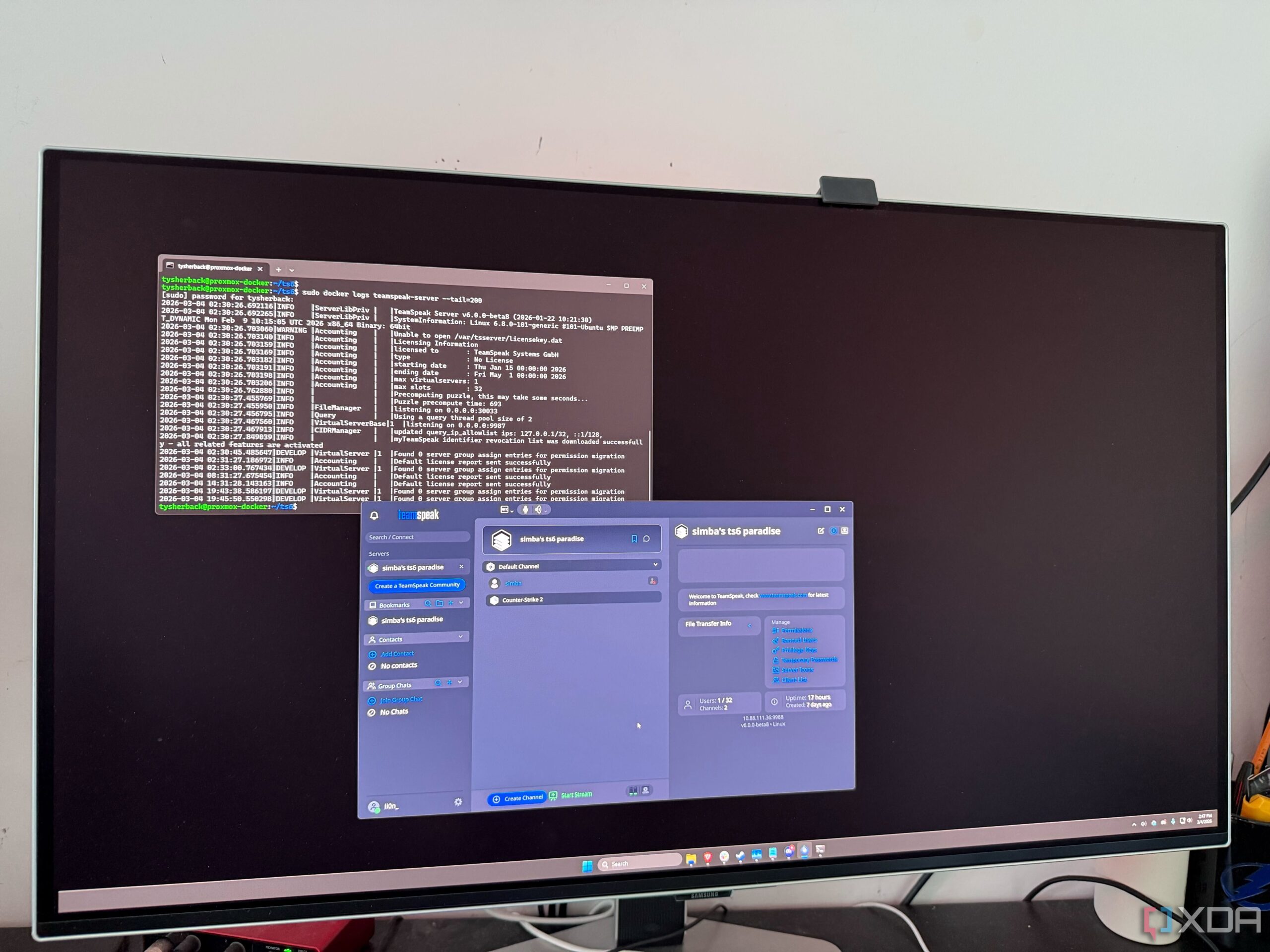

Wall Street Analysts React to Intel’s Performance

Recent reports from various brokerages reflect a mixed outlook for Intel. On April 23, Wedbush reduced its price target from $20.00 to $19.00, maintaining a “neutral” rating. Conversely, Bank of America upgraded Intel from an “underperform” rating to “neutral” and raised its price target from $19.00 to $25.00 on March 13.

Analysts at Cfra Research have upgraded Intel to a “hold” rating, while Seaport Res Ptn assigned it a “strong sell” rating on April 30. In a separate report, Sanford C. Bernstein adjusted its price target from $25.00 to $21.00 with a “market perform” rating. Overall, five analysts currently rate the stock as a sell, while twenty-six have issued a hold rating and one has given it a buy rating. According to data from MarketBeat, Intel holds an average rating of “Hold” with a consensus price target set at $21.76.

Current Stock Performance and Earnings Report

On April 24, Intel shares opened at $23.82, reflecting a 1.6% increase. The stock has a 50-day simple moving average of $21.27 and a 200-day average of $21.29. Intel’s current financial ratios indicate a current ratio of 1.31, a quick ratio of 0.93, and a debt-to-equity ratio of 0.42. The company’s market capitalization stands at $103.90 billion.

In its latest earnings report, Intel announced earnings per share (EPS) of $0.13 for the quarter, surpassing analysts’ expectations by $0.12. The company reported revenue of $12.67 billion, which exceeded the consensus estimate of $12.26 billion. Despite these results, Intel experienced a 0.4% decline in revenue on a year-over-year basis, compared to $0.18 EPS during the same quarter the previous year. Analysts predict that Intel Corporation will post an EPS of -0.11 for the current fiscal year.

Intel Corporation is a global leader in designing and manufacturing computing products and services. The company operates through several segments, including Client Computing Group, Data Center and AI, and Intel Foundry Services, among others. Its portfolio features a range of products, from central processing units (CPUs) to advanced memory and storage solutions.

For those interested in tracking further developments or holdings related to Intel, resources such as HoldingsChannel.com provide access to the latest 13F filings and insider trades for the company.