The investment landscape is illuminated by a head-to-head comparison of two small-cap business services companies: Black Diamond Group and UMC. Investors are keen to understand which company might present a more attractive opportunity based on various financial and operational metrics.

Risk and Volatility Assessment

When evaluating investment risk, Black Diamond Group has demonstrated a beta of 0.64, indicating that its stock price is approximately 36% less volatile than the S&P 500. In stark contrast, UMC exhibits a significantly higher beta of 33.65, suggesting its stock is 3,265% more volatile than the S&P index. This substantial difference in volatility may influence an investor’s decision depending on their risk tolerance.

Financial Performance Overview

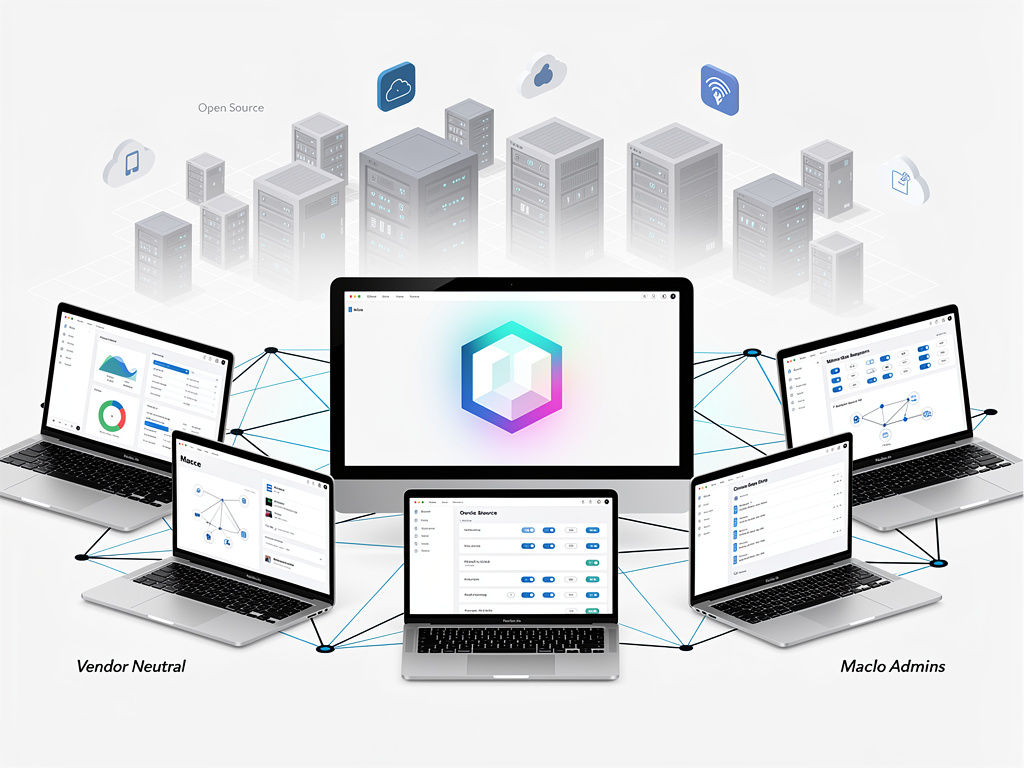

In terms of financial performance, Black Diamond Group outpaces UMC in revenue and earnings. The company operates through two segments: Modular Space Solutions and Workforce Solutions. It provides modular space rentals and workforce housing solutions, catering to diverse sectors including construction, education, healthcare, and resource management. Black Diamond Group was founded in 2003 and is headquartered in Calgary, Canada.

UMC, on the other hand, focuses on medical insurance claims coding and processing, alongside other services for healthcare providers. Founded in 1989 and based in Pampa, Texas, UMC serves a niche market primarily composed of hospitals and medical clinics in the United States.

The profitability metrics also reveal a distinct advantage for Black Diamond Group, which records superior net margins, return on equity, and return on assets compared to UMC. This suggests that Black Diamond Group may be more efficient in converting revenue into profits.

Analyst recommendations further bolster the case for Black Diamond Group, as it has received more favorable ratings than UMC. According to MarketBeat, Black Diamond Group excels in seven out of eight financial factors compared to its competitor, highlighting its stronger position within the market.

As investors weigh their options, the distinctive operational focuses and financial health of both companies will likely play a pivotal role in determining their attractiveness as investment opportunities. With Black Diamond Group’s robust performance metrics and lower volatility, it may appeal more to conservative investors seeking stability. In contrast, UMC’s higher volatility could attract those willing to embrace greater risk for potential rewards.

In conclusion, the comparison between Black Diamond Group and UMC illustrates the complexities of investment decisions in the small-cap business services sector. The insights derived from this analysis provide valuable context for investors aiming to navigate the ever-changing financial landscape.