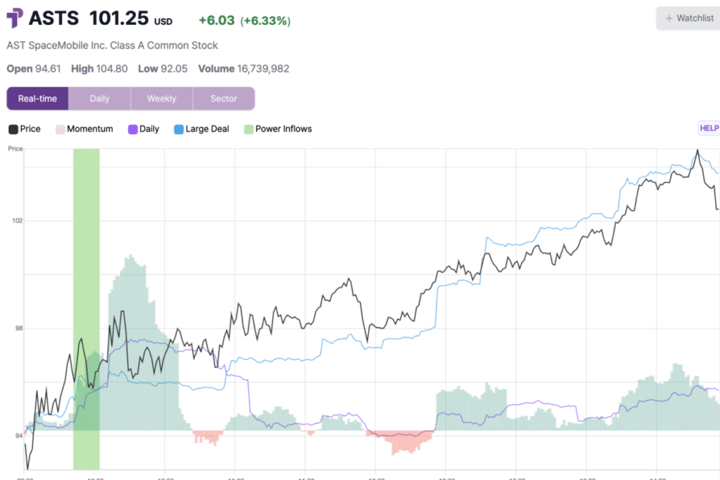

AST SpaceMobile Inc (NASDAQ:ASTS) saw a notable surge in its stock price following a significant Power Inflow alert on January 15, 2026. At 09:57 AM EST, the stock triggered this bullish indicator, which is closely monitored by traders focused on order flow analytics. The alert was issued when ASTS was priced at $95.81, indicating a strong shift in buying interest from both retail and institutional investors.

Following the Power Inflow signal, ASTS experienced an immediate rise in its stock price, eventually peaking at $104.80, marking a substantial intraday gain of 9.38%. This swift increase illustrates the potential impact of real-time trading signals on market momentum, especially during times when price action may appear stagnant or declining.

Understanding the Power Inflow Signal

The Power Inflow alert is a proprietary signal developed by TradePulse, designed to highlight significant shifts in order flow. Issued within the first two hours of the trading day, it indicates strong buying activity, suggesting a higher probability of positive price movement for the remainder of the trading session. By examining real-time buying and selling behavior, traders gain insights into market sentiment and price action, allowing for more informed decision-making.

At the moment the alert was activated, ASTS was positioned at $95.81. The stock’s performance following the signal underscores the efficacy of monitoring order flow data. Traders who acted on the Power Inflow alert had the opportunity to realize significant short-term gains.

Market Impact and Future Considerations

The post-alert performance of ASTS highlights the value of order flow analytics in identifying bullish intraday momentum. As of the latest updates, ASTS is trading around $116, reflecting an increase of 14% from the previous day’s close. This consistent upward trend may further attract interest from investors seeking to capitalize on the stock’s positive trajectory.

This article is intended for informational purposes only and does not constitute financial advice or investment recommendations. The analysis is based on stock order flow data, but accuracy cannot be guaranteed. Investing carries risks, including the potential loss of principal. Investors should consult a licensed financial advisor prior to making any investment decisions.

The recent trading activity surrounding AST SpaceMobile serves as a compelling case study in the impact of real-time order flow analytics on stock performance, illustrating the potential for substantial gains in a dynamic market environment.