Every product that crosses international borders, from coffee beans to semiconductors, requires a Harmonized System (HS) code. These codes play a pivotal role in determining tariffs, trade statistics, and regulatory treatment, making customs classification a fundamental aspect of global commerce. Despite its critical nature, the process remains largely manual, often relying on spreadsheets and fragmented systems, leading to inefficiencies and avoidable costs throughout supply chains.

Customs classification encompasses over 5,000 commodity groups, each with distinct rules and national variations. Errors in classification can result in penalties, shipment delays, and audit disputes. For companies managing thousands of stock-keeping units (SKUs) across various markets, even minor inaccuracies can lead to significant financial losses. For instance, a company with production sites in different regions may have varying classifications for the same product. A product rated as “A” in Europe could be categorized as “B” in North America. This inconsistency can lead to stock shortages in one area while causing surplus inventory in another.

Inconsistent material classifications exacerbate these issues. A chemical product may have different internal codes depending on whether it is entered into the system by procurement, quality control, or logistics. When managing a portfolio worth $250 million, such discrepancies can distort the entire planning model and disrupt demand forecasts when underlying classification logic is flawed.

The Challenges of a Manual System

The reliance on human interpretation in customs classification is a significant challenge. Classifiers must navigate varying descriptions, incomplete data, and differing national interpretations of global standards. For example, a company shipping wireless headsets might classify them as “audio equipment” in one market and as “communication devices” in another. Each classification carries different tariff rates, resulting in financial uncertainty and compliance risks.

Furthermore, the manual classification process can slow supply chains. Customs brokers often face time pressure to verify or correct codes, which can lead to delays in container movement and missed inventory launch windows. In sectors like pharmaceuticals, misclassifying active ingredients can have serious repercussions, delaying production schedules and impacting patient care worldwide. Classification errors can accumulate quietly but can surface later as costly audits, penalties, or supply interruptions.

Harnessing AI for Enhanced Classification

Artificial intelligence (AI) offers a promising solution to the challenges of customs classification. Utilizing natural language processing and machine learning, AI systems can analyze product descriptions and historical data to predict the correct HS code with high accuracy. These systems adapt to evolving regulations, providing a scalable alternative to traditional methods.

AI models trained on millions of product records can identify linguistic and technical patterns often overlooked by humans. For instance, they can recognize that terms such as “men’s cotton T-shirt” and “100% cotton knit top” belong to the same category, regardless of phrasing. Rather than relying solely on keyword matching, AI systems interpret context, material composition, and product function.

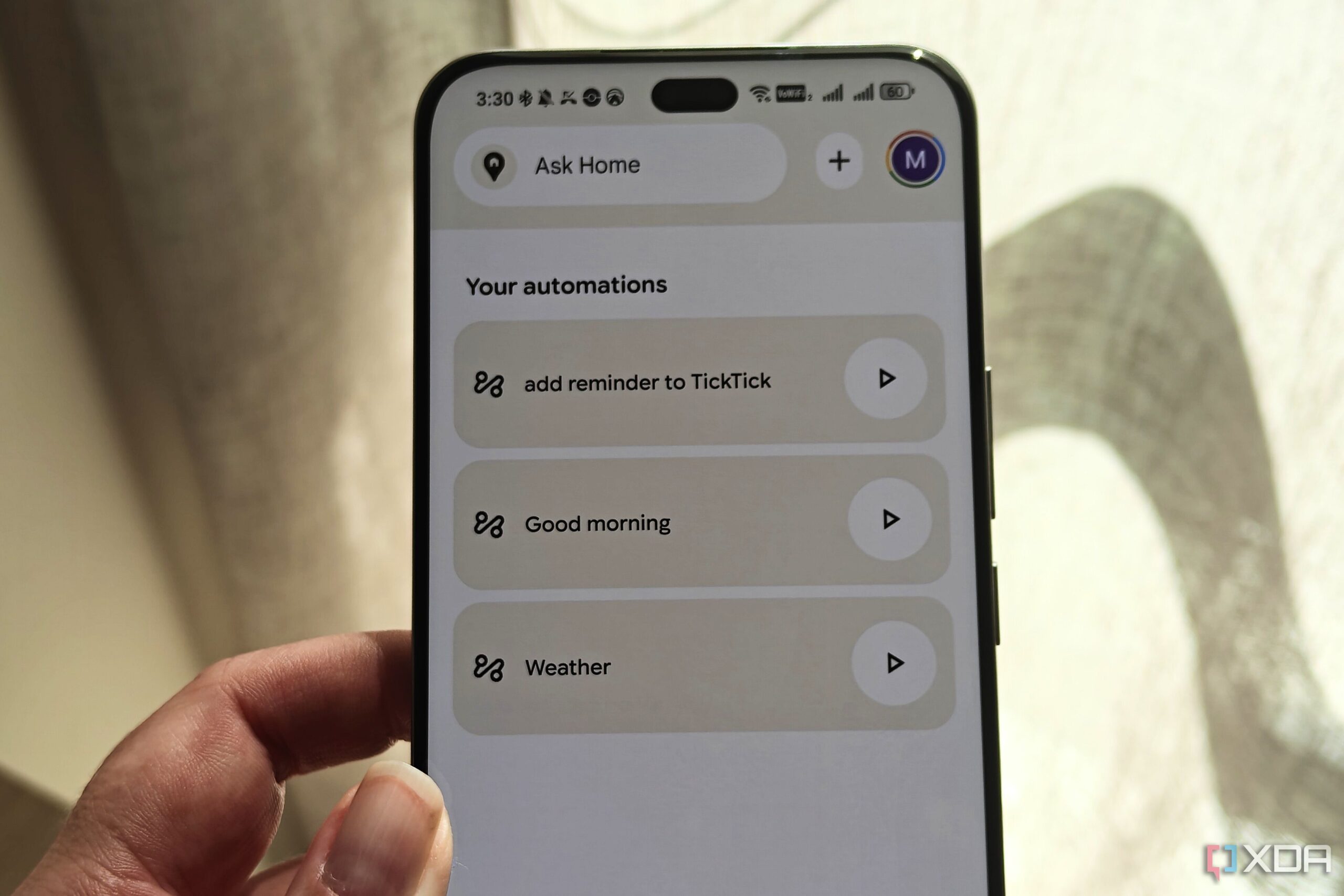

By integrating AI into Software as a Service (SaaS) platforms, companies can achieve a more global, consistent, and collaborative approach to classification. Logistics providers can connect their enterprise resource planning (ERP) systems directly to an AI engine, which automatically suggests HS codes accompanied by confidence scores and audit trails. Human experts can then review and adjust these recommendations, transforming classification from a potential bottleneck into an efficient, transparent workflow.

The benefits of implementing AI extend beyond mere accuracy. A well-executed AI system can reduce customs delays, enhance the consistency of global classifications, and improve calculations of landed costs. This integration strengthens sourcing, pricing strategies, and forecasting decisions. Additionally, AI-driven automation allows companies to scale operations without proportionately increasing staff, enabling experts to focus on exceptions and regulatory nuances.

Adopting AI in trade compliance, however, requires a commitment to governance and cultural readiness. Some organizations may hesitate to rely on algorithms for regulatory decisions due to concerns about liability and control. Yet, modern AI systems are designed to be auditable and transparent, providing clear explanations for every classification recommendation. For example, a dashboard could illustrate the rationale behind a specific code selection, linking it to relevant regulations and outlining the reasoning step by step. This transparency transforms AI from a black box into a reliable partner that complements human expertise.

Strong data governance is crucial for the successful implementation of AI systems. Even the most advanced algorithms cannot perform effectively with inconsistent descriptions or incomplete specifications. Organizations must approach implementation iteratively, supported by clear key performance indicators (KPIs) and disciplined change management.

While customs classification may seem a small component of global trade, its ripple effects are substantial. Errors can lead to delays, inflated costs, and strained supplier relationships. AI-powered SaaS solutions present a practical and scalable remedy, bringing accuracy, speed, and consistency to one of the most vital processes in commerce. As global trade evolves, organizations that effectively combine human expertise with algorithmic precision will likely stand out, particularly in classification, which is repetitive, rules-based, and directly linked to financial outcomes.