Republican leaders in the House are racing toward a Wednesday vote on President Donald Trump’s tax and spending cuts package. This high-stakes maneuver aims to capitalize on the momentum from a narrow Senate approval, effectively challenging members to align with their party’s leader or risk political fallout. The urgency stems from Trump’s insistence on a July 4 deadline.

Meanwhile, a significant legal development has emerged as Paramount agrees to a $16 million settlement with Trump over a contentious “60 Minutes” interview. This case, viewed by some as a test of free speech boundaries, underscores the complex interplay between media and politics.

Paramount Settles Lawsuit Over ’60 Minutes’ Interview

In a notable legal settlement, Paramount has agreed to pay $16 million to resolve a lawsuit filed by President Trump. The lawsuit concerned the editing of a “60 Minutes” interview with then-Vice President Kamala Harris in October. Paramount announced that the settlement funds would be directed to Trump’s future presidential library, not to him personally, and emphasized that no apology was part of the agreement.

Trump’s legal team argued that the editing by CBS News caused him “mental anguish,” while Paramount and CBS maintained that the edits were not intended to favor Harris. The media giants had previously sought to dismiss the lawsuit, which was filed in Amarillo, Texas. The White House has yet to comment on the settlement.

“Republicans, don’t let the Radical Left Democrats push you around. We’ve got all the cards, and we are going to use them,” Trump asserted on his social media platform.

House Republicans Face Pressure Ahead of Tax Bill Vote

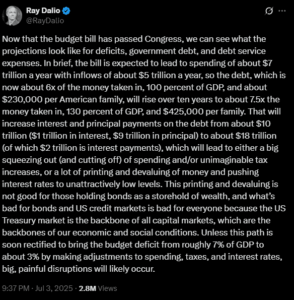

The House is poised for a critical vote on Trump’s tax and spending cuts package, following its razor-thin passage in the Senate. Vice President JD Vance, acting as Senate president, cast the decisive vote in favor of the measure. Despite the Senate’s approval, some House Republicans have expressed reservations about the bill, while Democrats remain firmly opposed.

This legislative push reflects Trump’s broader strategy to consolidate Republican support and deliver on campaign promises. The bill’s passage is seen as crucial for maintaining party unity and demonstrating legislative effectiveness ahead of upcoming elections.

Historical Context and Expert Opinions

This legislative effort is reminiscent of previous high-profile tax reforms, such as the Tax Cuts and Jobs Act of 2017. Like its predecessors, the current bill aims to stimulate economic growth through tax reductions, though critics argue it disproportionately benefits the wealthy and increases the national deficit.

Economists are divided on the bill’s potential impact. Some argue it could boost consumer spending and investment, while others warn of long-term fiscal challenges. Political analysts note that the bill’s success or failure could significantly affect the Republican Party’s standing in the upcoming midterms.

According to political analyst Jane Doe, “The outcome of this vote will likely shape the political landscape for years to come, influencing both policy direction and electoral dynamics.”

Implications and Future Outlook

The impending House vote represents a critical juncture for Trump’s legislative agenda. Success could bolster his influence within the party and strengthen his position ahead of future electoral contests. Conversely, failure could expose divisions within the Republican ranks and complicate efforts to advance other policy initiatives.

As the House prepares for this pivotal vote, all eyes will be on Republican lawmakers to see whether they align with Trump’s vision or chart a different course. The outcome will not only affect immediate policy but also set the tone for the party’s future direction.

As the political drama unfolds, stakeholders across the spectrum will be closely monitoring the developments, gauging their implications for both the present and the future of American politics.