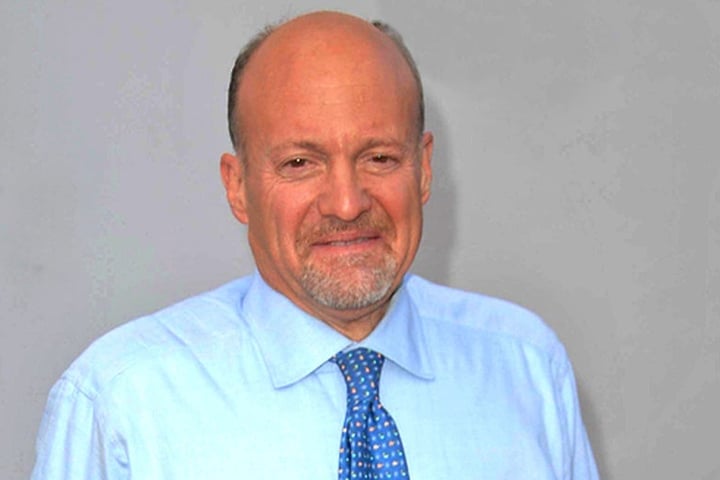

Television personality and financial commentator Jim Cramer has voiced strong support for bank stocks, declaring that many are undervalued. In a recent post on X, he emphasized that “the banks are all cheap,” but pointed to Capital One Financial Corp. (NYSE: COF) as the standout opportunity in the current market. Cramer identified this Virginia-based institution as “the cheapest of all,” suggesting it has the “most upside” compared to its competitors.

Cramer’s endorsement follows a significant milestone for Capital One, which completed its acquisition of Discover Financial Services for $35.4 billion earlier this year. This strategic move is expected to yield substantial synergies moving forward. Cramer, who has been a long-time advocate for Capital One, noted that he has upheld a bullish outlook on the stock, which has appreciated by approximately 60 points since he began supporting it.

Market Performance and Analyst Insights

Year-to-date, Capital One has performed well, increasing by 29.15%. The stock currently trades at a price-to-earnings ratio of 10.91, which is lower than several of its peers. For context, other major banks have posted the following year-to-date performances:

– JPMorgan Chase & Co. (NYSE: JPM): +25.21%, P/E of 14.61

– Wells Fargo & Co. (NYSE: WFC): +26.64%, P/E of 13.04

– Bank of America Corp. (NYSE: BAC): +20.89%, P/E of 12.32

– Citigroup Inc. (NYSE: C): +56.46%, P/E of 11.03

– Goldman Sachs Group Inc. (NYSE: GS): +52.46%, P/E of 15.82

The banking sector has experienced a notable resurgence this year, largely attributed to the successful results of the 2025 Federal Reserve stress test. Major banks not only passed but also returned $100 billion in dividends and buybacks, showcasing their robust capital positions.

Several analysts have echoed Cramer’s optimism regarding Capital One. Recently, Wolfe Research initiated coverage with an “Overweight” rating and set a target price of $270 per share, indicating a potential upside of 16.97%. Similarly, analysts from Citigroup have reiterated their “Buy” rating while increasing their target from $275 to $290, representing a 25.64% upside from current levels.

Stock Trends and Investor Sentiment

On Tuesday, shares of Capital One closed at $230.81, reflecting a slight increase of 0.09%. Overnight, the stock gained an additional 0.52%. It has received high marks for momentum in Benzinga’s Edge Stock Rankings, indicating a positive price trend in both the short and long term.

As investors navigate the banking landscape, Cramer’s insights and the encouraging performance of Capital One may offer a compelling case for those looking to capitalize on the current market conditions. With significant capital reserves and a strategic acquisition under its belt, Capital One appears well-positioned to leverage its strengths in the evolving financial landscape.

This article does not provide investment advice. For tailored investment strategies, individuals should consult a financial advisor.