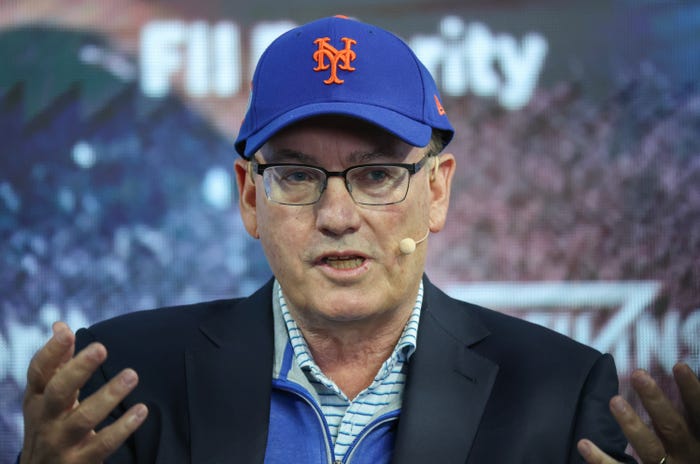

UPDATE: Point72 Asset Management, led by founder Steve Cohen, is making a significant move by splitting its stock-picking unit into two separate brands starting in January 2026. This strategic change, outlined in an internal memo, aims to enhance access to corporate leaders for its portfolio managers.

The two new entities will be known as Point72 Equities and Valist. According to the memo reviewed by Business Insider, Valist will kick off with approximately a dozen investing teams, each focused on various sectors. The decision reflects a broader trend among multistrategy funds, which are increasingly altering their relationships with investment banks to gain better access to CEOs and insights from bank analysts.

Point72, boasting assets of $41.5 billion, plans for the two brands to operate from different floors in their office, signaling a distinct operational approach, while maintaining the same leadership under Harry Schwefel, the firm’s co-chief investment officer. The memo emphasizes that both units will share resources and uphold a collegial culture, despite their physical separation and distinct branding.

The establishment of Valist is partly driven by the need for enhanced sell-side coverage, which has become critical in today’s competitive investment landscape. As covered previously by Business Insider, the growing influence of firms like Point72, alongside peers such as Millennium and Citadel, has shifted the dynamic between buy-side firms and their counterparts on Wall Street, particularly concerning corporate access.

Through the formation of Valist, portfolio managers will be better positioned to forge direct connections with company executives, thereby improving the quality of their research and trading strategies. This change mirrors similar strategies employed by competitors; for instance, Citadel operates four different fundamental equities units, aiming to maximize their market engagement.

Cohen and Schwefel stated in the memo, “Our fundamental equities strategy has been the flagship of our firm for over 30 years, and we look forward to building on that foundation.” This restructuring is designed to position Point72 for further growth, highlighting the firm’s commitment to adapting to the evolving financial market.

As this development unfolds, market watchers and investors will be keen to see how Point72 leverages its new structure to enhance its competitive edge. The impact of these changes in corporate access and investment strategies could set the tone for future operations within the hedge fund industry.

Stay tuned for more updates as this story develops.