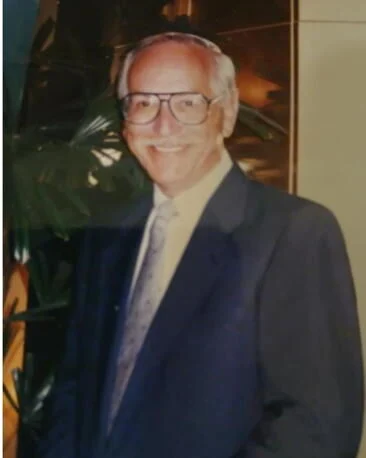

UPDATE: Coach’s former CEO, Lew Frankfort, has declared that producing high-quality bags in the United States is not feasible for brands seeking to maximize profits. In a recent podcast interview with Yahoo Finance’s Opening Bid, Frankfort asserted that for consumers to receive the “best possible value,” manufacturers must look beyond U.S. borders.

Frankfort’s remarks come as the fashion industry grapples with ongoing tariff challenges. He emphasized that while it is technically possible to manufacture bags profitably in the U.S., achieving true value necessitates production overseas. “If you want to give consumers the best possible value, you really need to make most of your products outside the United States,” Frankfort explained, highlighting the importance of using high-quality materials overseen by skilled artisans.

As the U.S. economy remains intertwined with global markets, Frankfort suggested that current tariffs are a temporary hurdle. “The tariffs that are in place today, and threatened for tomorrow, are something that we’re going to live with through this administration,” he stated, but he believes the nation will ultimately thrive as part of a global economy.

Coach, which originated as a leather bag shop in New York City in 1941, now sources the majority of its products from Asia. Its parent company, Tapestry, predominantly manufactures in Vietnam, Cambodia, and the Philippines. In its latest quarterly report, Tapestry revealed Coach’s sales surged to $1.43 billion, marking a 14% increase year-over-year.

Amidst the shifting landscape, some companies are reconsidering their production strategies. Executives from LVMH indicated during an April earnings call that they are exploring opportunities to enhance Louis Vuitton production in the U.S. Meanwhile, tech giant Apple has committed to investing $600 billion into U.S. manufacturing over the next four years.

Conversely, Kering, the parent company of Gucci and YSL, has no plans to shift its production out of Europe. CEO François-Henri Pinault remarked in February that relocating would be counterproductive, emphasizing the heritage tied to their Italian and French production.

As the conversation surrounding production continues, Frankfort’s insights underline a critical juncture for brands navigating the complexities of tariffs and consumer expectations. For now, the debate over where to produce high-quality bags remains urgent, with significant implications for both manufacturers and consumers alike.

Stay tuned for more developments on this evolving story.