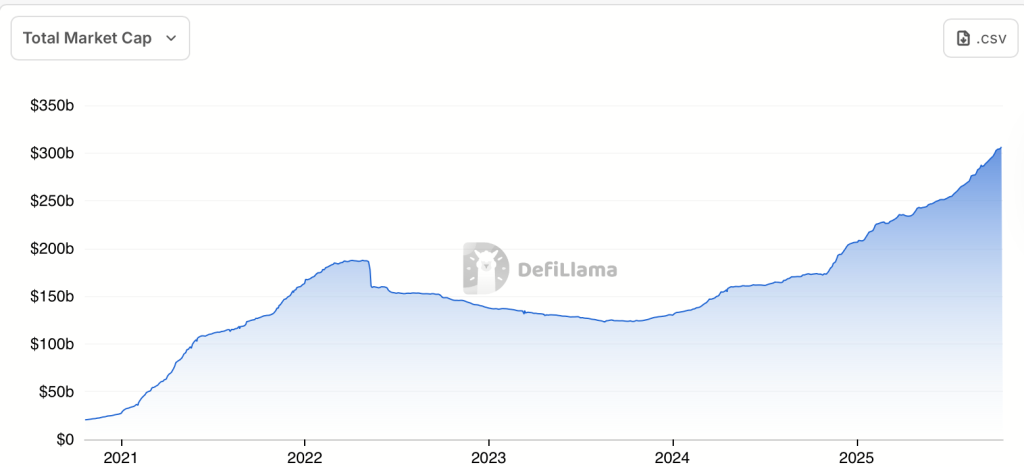

The total supply of stablecoins has surged to a record high of $304.5 billion, indicating a significant liquidity buildup in the cryptocurrency market. This influx of capital suggests that investors are preparing to reallocate funds into high-yield opportunities, including Bitcoin (BTC), Decentralized Finance (DeFi) projects, and various altcoins. As Bitcoin trades near $107,000, optimism is returning to the market, driven by renewed institutional interest and increasing on-chain activity.

Historically, a rise in stablecoin reserves has preceded notable rallies in Bitcoin and other digital assets. The current accumulation signals that a significant uptrend may be on the horizon. As stablecoins are often pegged to the U.S. dollar, they provide a stable means for investors to navigate the volatile crypto landscape. The increase in stablecoin supply reflects a growing confidence among investors and a readiness to engage with riskier assets.

Implications for DeFi and Altcoin Markets

The current environment indicates that substantial liquidity could soon be redirected towards DeFi platforms and tokenized real-world assets (RWAs). DeFi applications, including lending platforms and decentralized exchanges, are attracting investors seeking real yield opportunities. As security and institutional-grade protocols improve, DeFi is increasingly viewed as an integral part of the financial ecosystem.

Moreover, the tokenization of traditional assets such as bonds, treasuries, and real estate is gaining traction. Major financial institutions like BlackRock and Standard Chartered are exploring blockchain-based settlements, utilizing stablecoins as a primary medium for transactions. This shift is indicative of a broader trend towards integrating traditional finance with decentralized systems.

Analysts point to several potential catalysts that could unleash this substantial liquidity pool. Regulatory clarity, increased institutional adoption, and macroeconomic changes could all contribute to a significant influx of capital into the cryptocurrency market. A favorable policy decision or a major financial institution adopting stablecoin payments may serve as a trigger for the next liquidity supercycle in crypto.

Market Outlook

With the stablecoin supply reaching an all-time high, the implications for the crypto market are profound. The potential for reinvestment into Bitcoin, Ethereum, and DeFi tokens could drive these assets to new heights. As the market conditions evolve, the interplay between stablecoin reserves and digital asset performance will be closely monitored by investors and analysts alike.

In summary, the record-breaking $304.5 billion in stablecoins represents more than just idle cash; it serves as a critical resource that could propel the cryptocurrency market into a new phase of expansion. As DeFi and RWAs gain momentum, this liquidity is poised to reinvigorate the market landscape, potentially setting the stage for a new bull run in the coming months.