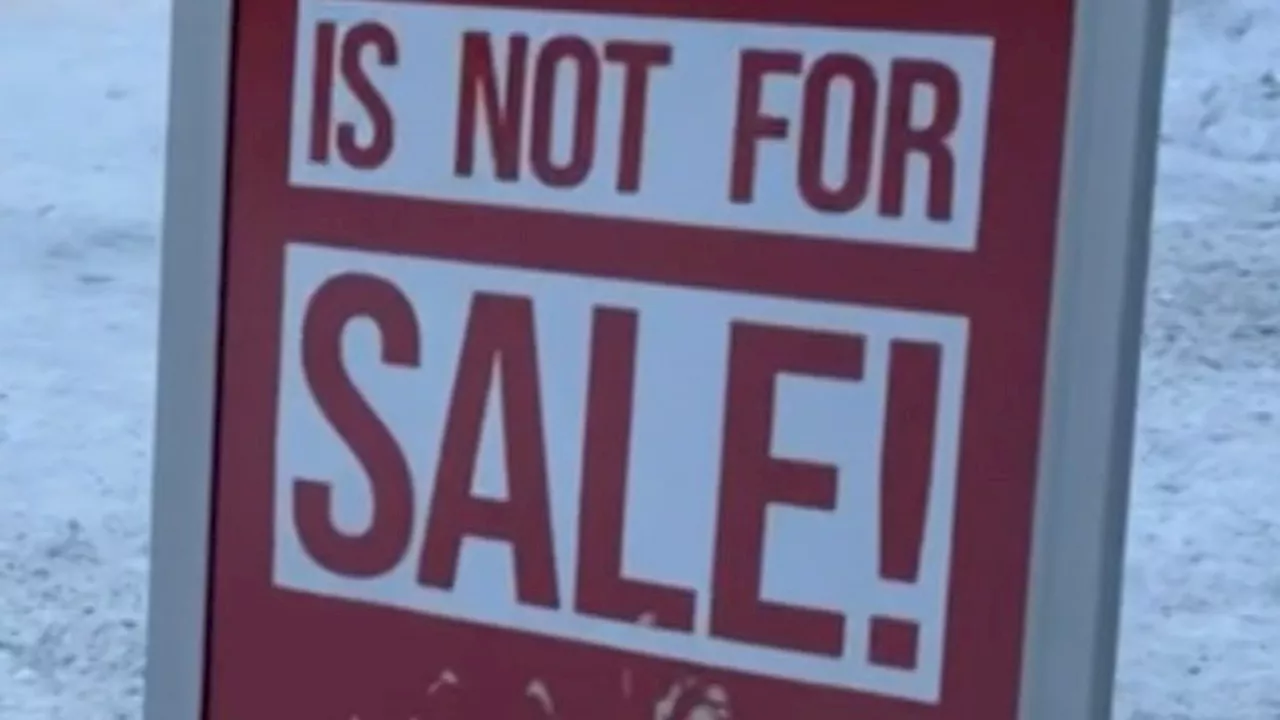

A recent ruling by California’s Fourth District Court of Appeal has upheld the legality of San Diego’s Measure C, a hotel tax hike aimed at funding the expansion of the San Diego Convention Center, as well as addressing homelessness and road repairs. This decision affirms an August 2024 ruling from a San Diego Superior Court judge, confirming the measure’s passage during the March 2020 ballot.

The measure sought to increase the city’s transient occupancy tax rate, which is the tax paid by hotel guests. It is projected to generate approximately $4 billion for the convention center expansion, $2.1 billion for homeless initiatives, and $650 million for road repairs over a period of 42 years. San Diego Mayor Todd Gloria described the ruling as a significant victory for the city and its residents. He stated, “This ruling is a win for San Diego — and for the voters who overwhelmingly said yes to this back in 2020.”

With the court’s decision, the San Diego City Council is set to introduce and pass an implementation ordinance. This ordinance will detail the timeline for collecting and allocating the additional tax revenue. However, the legal battle surrounding Measure C may continue. Attorney Cory Briggs, representing the California Taxpayers Action Network (CTAN), indicated that his client is exploring options for further legal action, which could include requesting a rehearing or petitioning the state Supreme Court.

Measure C received 65.24 percent support from voters in March 2020, although it initially appeared to have failed to meet the required two-thirds supermajority for special tax initiatives. Legal interpretations have since evolved, allowing for simple majority approval when tax hikes are initiated by citizens. Following a series of court decisions affirming this view, the San Diego City Council officially declared victory in April 2021.

The measure’s legitimacy has been the subject of ongoing legal scrutiny, particularly regarding whether it constituted a citizens’ initiative or a city-sponsored initiative requiring a two-thirds vote. A trial court previously ruled in favor of the measure being classified as a citizens’ initiative, thus validating its passage. Subsequently, the city implemented new transient occupancy tax rates, increasing the rate from 10.5 percent to 13.75 percent for hotels closest to the convention center. Rates for mid-range hotels are set at 12.75 percent, while those farther away are charged 11.75 percent. Notably, an existing 2 percent surcharge for tourism marketing further increases the effective rates.

Despite this recent ruling, the city has set aside proceeds from the higher rates until the legal matters are fully resolved. The CTAN’s appeal argued that the lower court erred in affirming the measure’s status as a citizens’ initiative. The appellate court dismissed this claim, stating that the trial court correctly found that CTAN did not prove that the city had substantial control over Measure C.

Justice Terry O’Rourke, who authored the appellate court’s decision, affirmed the lower court’s judgment, with Justices Judith McConnell and Truc Do concurring. The city now has the green light to secure financing through the issuance of bonds based on projected tax revenue, aimed at funding the convention center upgrades.

While the city anticipates generating around $82 million from the higher hotel taxes in the current fiscal year, significant financial hurdles remain. The planned expansion of the convention center cannot commence until after 2026 due to a settlement with the current leaseholder of the waterfront parcel designated for the project. Additionally, costs for the expansion may exceed initial estimates, complicating the financial landscape.

The outcome of the ongoing legal disputes will play a vital role in determining the future of San Diego’s convention center expansion, as well as the city’s broader initiatives to tackle homelessness and improve infrastructure.