The Minnesota Department of Commerce has announced significant health insurance rate increases for 2026, affecting many residents enrolled in the state’s health insurance marketplace, known as MNsure. Individuals covered through the Affordable Care Act (ACA) plans will experience an average rate hike of 22%, while those in small group plans will see a 14% increase.

These adjustments are driven primarily by escalating health care costs and the expiration of enhanced tax credits under the ACA, according to officials from the Department of Commerce. Approximately 163,000 Minnesotans are enrolled in the individual market, while around 200,000 are in small group plans, based on data from the state Department of Health.

Impact of Federal Government Shutdown

The announcement of these rate increases coincided with the federal government shutdown that commenced at midnight. This shutdown was partly attributed to ongoing disputes over health care issues, including the expiration of ACA credits and proposed Medicaid cuts. In light of these developments, Minnesota Governor Tim Walz and health care leaders emphasized the importance of renewing these financial supports during a press conference last month.

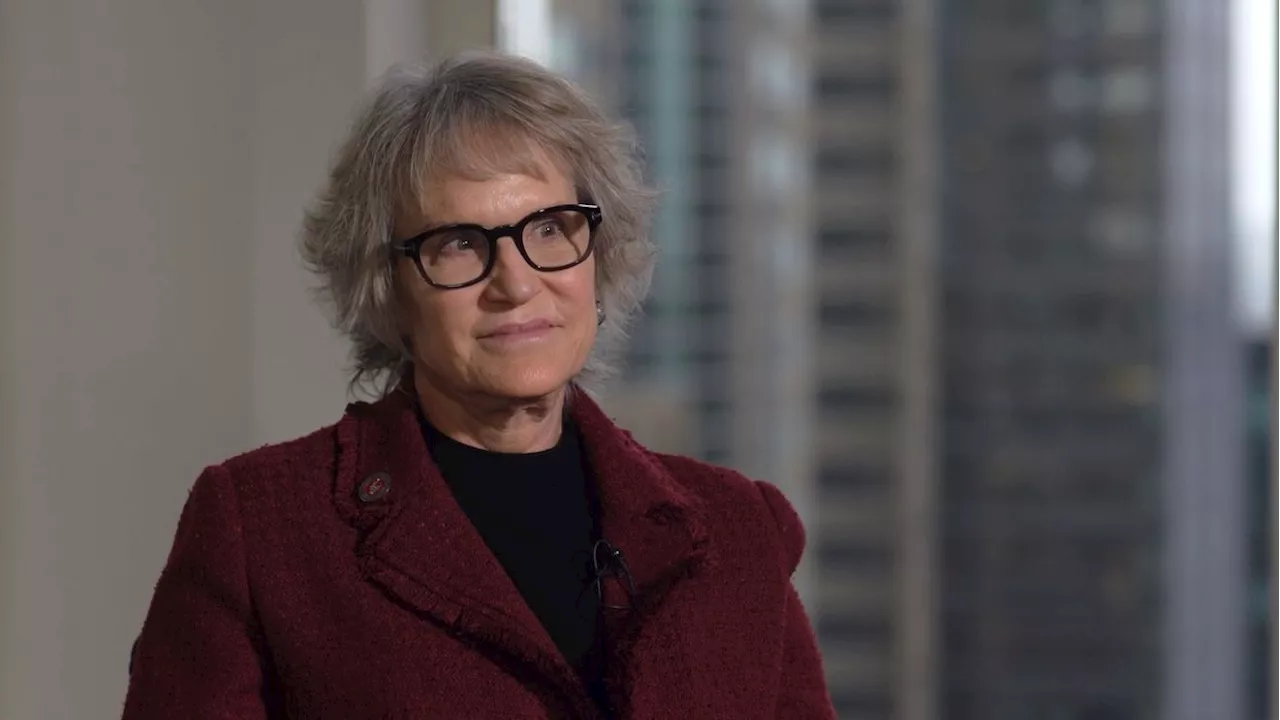

Libby Caulum, CEO of MNsure, stated, “We hope that Congress will take swift action to make the enhanced tax credits permanent, because every Minnesotan who has been able to stay covered with this financial help is another Minnesotan able to access the health care they need.”

Critical Dates and Future Implications

The Minnesota Department of Commerce typically announces these rates annually on October 1, ahead of the open enrollment period starting on November 1. The new premiums will take effect on January 1, 2026, coinciding with the date when the enhanced ACA credits are set to expire.

Caulum expressed concern about the tight timeline for potential changes, noting that while MNsure can implement “technical changes” if Congress acts to extend ACA credits, the deadline for such adjustments is rapidly approaching. “As soon as the rate release happens, there’s a whole host of things that MNsure does to get ready for open enrollment…so we’re really short on time here to keep it from getting confusing,” she remarked on September 23, 2025.

Without an extension of the ACA credits, MNsure estimates that nearly 90,000 Minnesotans could see an increase in their monthly premiums, further complicating access to affordable health care in the state. The urgency surrounding this issue highlights the critical need for federal action to support those reliant on these health care subsidies.

As Minnesota navigates these challenges, the focus remains on ensuring that residents have access to necessary health care services without facing prohibitive costs.