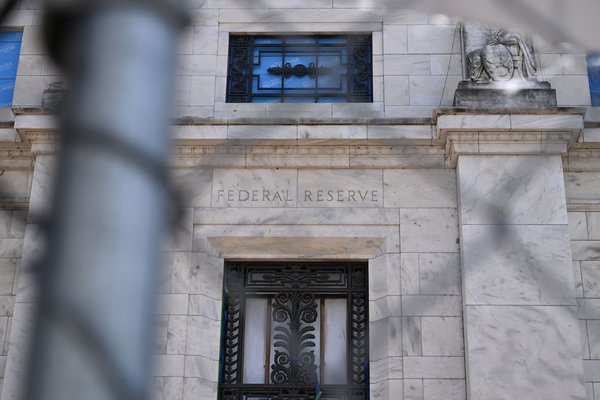

UPDATE: The Federal Reserve has just announced the termination of its specialized unit monitoring banks’ crypto activities, a significant move following the recent collapse of Silicon Valley Bank. This decision, confirmed earlier today, raises urgent questions about the future of cryptocurrency regulation and its impact on financial stability.

The Fed’s unit was established in response to the alarming developments surrounding banks’ engagement with digital currencies, particularly after the abrupt failure of Silicon Valley Bank in March 2023. With this program now being wound down, experts fear the ramifications for both banks and consumers dealing in cryptocurrency.

This development is crucial as it signals a shift in regulatory focus at a time when confidence in financial institutions is already fragile. The abrupt cessation of oversight could embolden banks to dive deeper into the volatile crypto market without sufficient safeguards in place.

Authorities stress that while the unit’s closure may streamline operations, it also poses risks. Industry leaders and consumer advocates are expressing deep concern about the lack of monitoring, especially given the increasing integration of cryptocurrencies into mainstream banking.

As the global financial community braces for the implications of this decision, analysts are urging stakeholders to prepare for potential instability in the cryptocurrency market. The Fed has not provided a timeline for any future regulatory actions, leaving many in the industry on edge.

What happens next? Watch for responses from major banks and crypto firms as they adjust to this new landscape. The lack of oversight could lead to increased volatility, making it imperative for investors to stay informed.

This breaking news is likely to spark discussions among regulators, financial experts, and consumers alike, highlighting the ongoing tension between traditional banking systems and the rapidly evolving world of cryptocurrencies. Share this story to keep others informed about these critical developments that could impact us all.