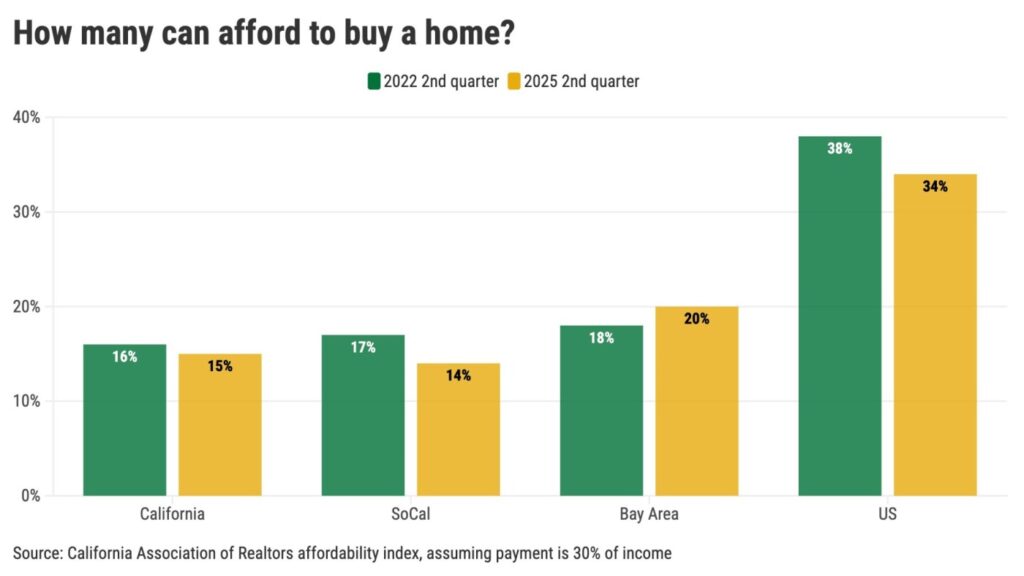

UPDATE: Home affordability in California has reached a staggering low of just 15%, far below the national average of 34%, according to the latest report from the California Association of Realtors. This urgent news reveals the growing housing crisis in the state, highlighting the pressing need for solutions as the housing market continues to shift dramatically.

As of spring 2025, the median home price in California stands at $905,680, requiring a household income of $232,400 to qualify for a mortgage. This figure represents a significant increase of $33,200 or 17% since 2022. Meanwhile, on a national scale, the median home price is $429,400, demanding an income of $110,400—an increase of $17,200 or 18% over the same period.

This drastic shift in affordability is largely attributed to rising interest rates, which have surged to 6.9% from 5.4% three years ago. Potential buyers are now facing increased monthly payments, with most spending up to 30% of their income on housing costs. The financial burden is exacerbated by the requirement of a 20% down payment, translating to $181,000 for a California home compared to $86,000 nationally.

The affordability crisis is not uniform across California. In the Bay Area, where the median home price is a staggering $1.4 million, buyers need an income of $359,200, up $22,000 or 7% since 2022. While a recent dip in prices has allowed 20% of Bay Area households to afford a home—up from 18% in 2022—the situation remains dire.

In contrast, Southern California’s median home price is $850,000, requiring an income of $218,400, a rise of $38,000 or 21% since 2022. Consequently, only 14% of households in the region can afford to buy, down from 17% in 2022.

According to Jonathan Lansner, business columnist for the Southern California News Group, the escalating prices and interest rates have created a challenging environment for prospective homebuyers. The data draws attention to the urgent need for policy changes and innovative solutions to address the housing crisis.

As this situation continues to evolve, it is crucial for stakeholders—ranging from lawmakers to housing advocates—to prioritize affordable housing initiatives. The implications of these affordability trends are far-reaching, affecting not only individual families but the overall economy and community stability.

WHAT’S NEXT: As the housing market remains a hot topic, authorities and experts will continue to monitor these trends closely. Expect more discussions around housing policies and potential legislative actions aimed at easing the financial burden on California residents.

Stay tuned for ongoing updates as this developing story unfolds, and share this crucial information to help raise awareness about the housing crisis affecting millions.